Calling all balanced dividend investors seeking a sturdy, resilient gem in the Materials sector!

Discover a well-covered large-cap Chemicals stock, with a low forward payout ratio of 33%, aligning comfortably with the industry’s average of 31%. This robust investment has a sterling record of increasing dividends for 51 years – ranking it within the top 10% of dividend stocks – and it shows no signs of stopping.

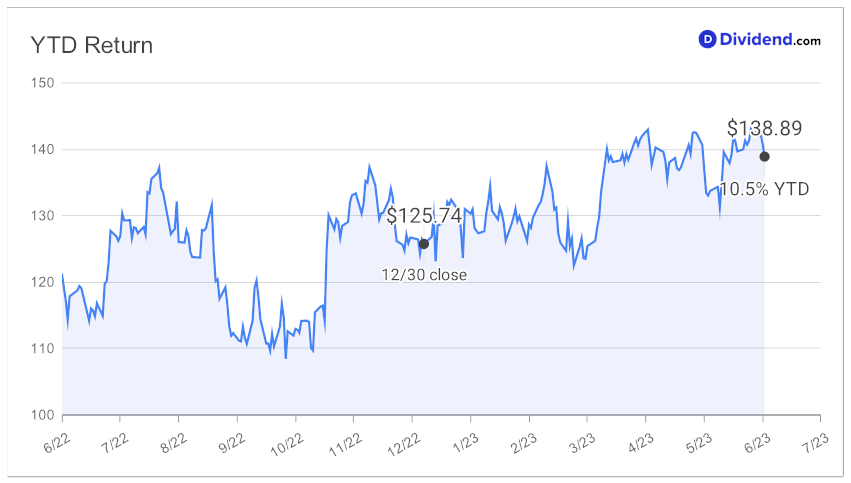

Despite the S&P 500 returning 14% year-to-date, this stock is not far behind with a solid 11% return, outshining the 2% average for the Chemicals industry.

Excitingly, the next payout estimation is a healthy $0.620/share, anticipated around July 21.

This recommendation process optimizes for an equal blend of yield, dividend safety, return potential, and risk, exclusively among Materials dividend stocks. Dive into the following in-depth analysis to uncover this promising addition to the Best Sector Dividend Stocks model portfolio.