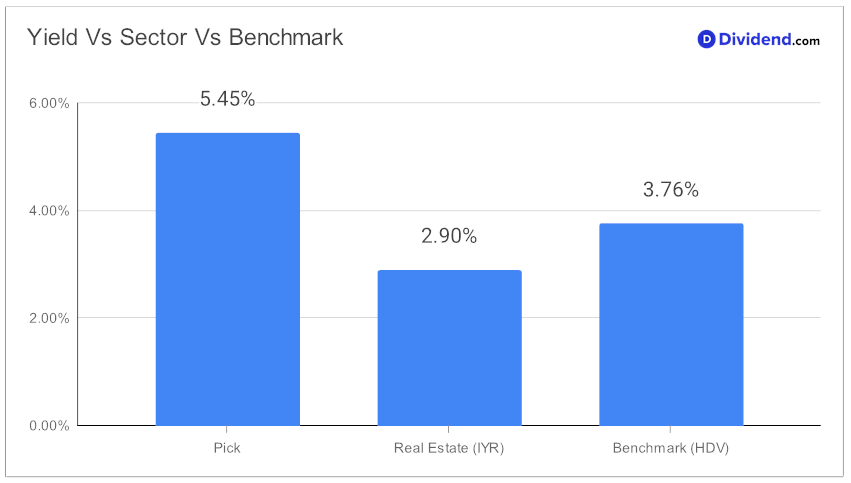

In the landscape of high dividend investments, a standout mid-cap equity Real Estate Investment Trust (eREIT) has recently garnered attention for its addition to a model portfolio revered by discerning high dividend investors. With a forward dividend yield of 5.45%, this entity not only offers a yield that places it within the top 20% of dividend-paying stocks but also slightly undercuts the eREIT industry average of 5.6%, marking it as a high yield investment to watch. Its commendable track record of seven consecutive years of dividend increases situates it in the top 30% for dividend growth, signaling a promising trajectory for future enhancements.

Investors will be keen to note the upcoming payout, estimated at $0.345 per share, anticipated around March 13, a detail not to be overlooked.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 16, 2024. This restaurant-focused REIT demonstrated a solid quarterly performance with a 4.9% increase in Adjusted Funds From Operations (AFFO) per share, driven by high rent collections and occupancy. The firm strategically expanded its portfolio by $333 million across diverse sectors, though it faced challenges from rising interest rates leading to a cautious approach in acquisitions.

Despite a moderated acquisition volume in the face of market volatility, the company remains optimistic about future opportunities. Its disciplined capital allocation and diversification strategy, along with a robust financial foundation, position it well for growth amid ongoing economic uncertainties.

This selection was meticulously made through a rigorous recommendation process that prioritizes yield attractiveness and dividend safety, with a measured consideration for return potential and associated risks. The following in-depth analysis delves deeper into the facets that make this eREIT a compelling addition to a high dividend portfolio, exploring the nuances that distinguish it from the broader market offerings.