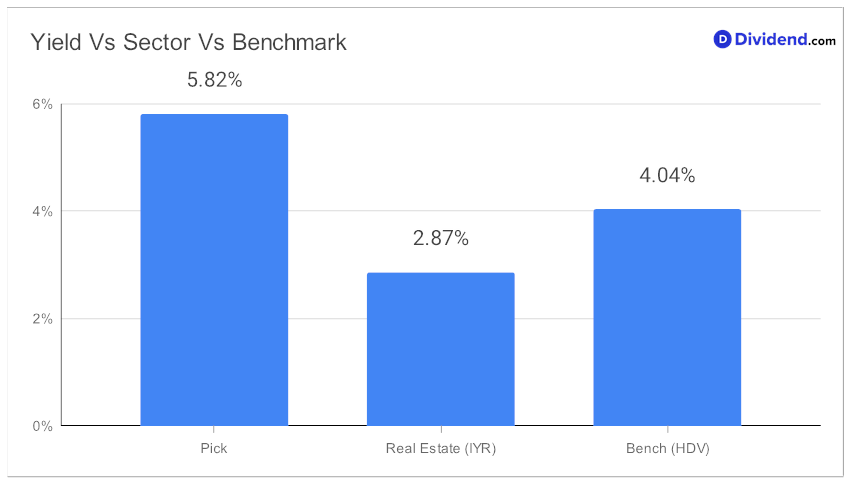

Are you seeking a well-covered mid-cap equity real estate investment trust (eREIT) that stands out in the high dividend investment space? Here’s a unique opportunity that offers a forward dividend yield of 5.82%, placing it in the top 20% of dividend stocks.

Unlike common dividend traps, this holding offers an attractive yield just above the eREIT industry average of 5.7%. With an impressive 34-year track record of dividend increases, ranking it in the top 10% of dividend stocks, future increases are anticipated.

Its 0.86 beta ensures monthly returns are not correlated to equity markets, offering diversification to your equity portfolio.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on Aug 4, 2023.

This addition to the Best High Dividend Stocks model portfolio was carefully chosen, optimizing for Yield Attractiveness and Dividend Safety, with consideration of Returns Potential and Returns Risk. Stay tuned for an in-depth stock analysis that follows!