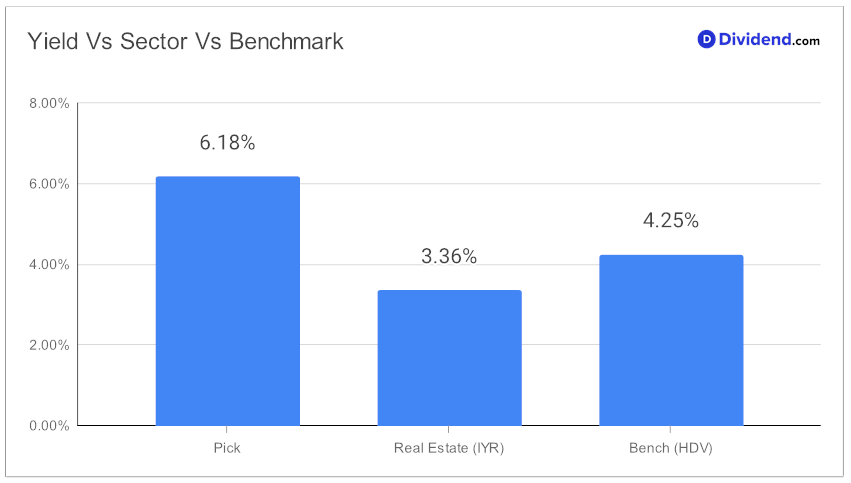

For high dividend investors seeking new opportunities, an intriguing small-cap electronic Real Estate Investment Trust (eREIT) has made a significant entry into the Best High Dividend Stocks model portfolio. This eREIT stands out with its robust 6.18% forward dividend yield, placing it in the upper echelons of dividend stocks, well above the industry average of 5.9%. Such a yield is not only attractive but also raises the bar for high yield investments. However, investors should exercise caution and steer clear of potential dividend traps.

Notably, this eREIT’s consistent 12-year history of dividend increases puts it in the top 10% of dividend stocks, signaling reliability and the likelihood of future growth. The next payout is particularly noteworthy – a substantial 4.7% increase to $0.450 per share, going ex-dividend on December 27. This payout marks a significant moment for investors looking for stable and growing income streams.

Even in a challenging market characterized by high interest rates, businesses that adopt an effective capital allocation strategy and specialize in a particular area can see significant advantages.

Our latest addition to this portfolio exemplifies this. It concentrates on convenience and automotive retail assets, leveraging its deep expertise in this sector. This focus, combined with robust tenant relationships and a proven track record of successful execution, offers it a distinctive edge. Additionally, its tactical approach to securing capital at favorable rates underscores its dedication to sustaining a robust investment pipeline while keeping a sound financial position, characterized by reasonable leverage.

The inclusion of this eREIT in the portfolio follows a rigorous recommendation process, prioritizing Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Returns Risk. This balanced approach ensures that only the most promising stocks make the cut. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 28, 2023.

The full in-depth analysis that follows delves deeper into this eREIT’s potential, exploring the reasons behind its selection and what it means for your dividend investment strategy. Stay tuned to uncover how this addition could reshape your portfolio’s performance and bring a new level of income stability and growth.