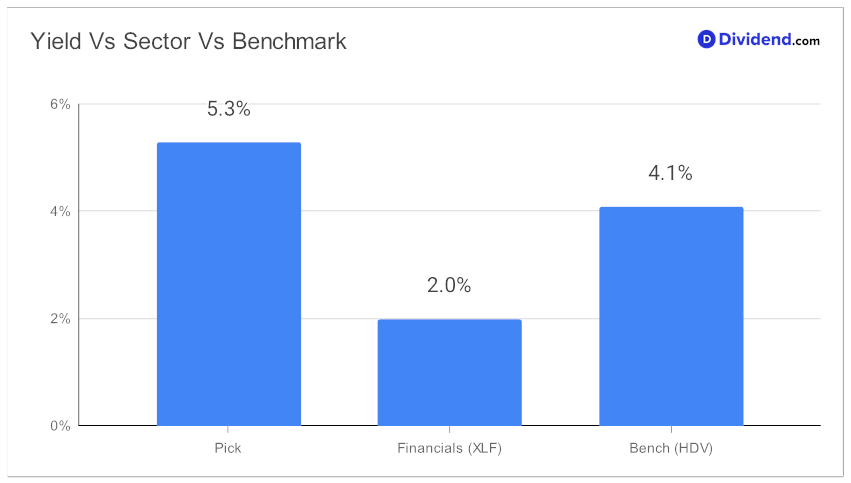

When it comes to high-yield dividend stocks, investors often face a trade-off between yield and safety. However, a standout in our Best High Dividend Stocks model portfolio offers the best of both worlds. This well-covered large-cap Insurance stock boasts a forward dividend yield of 5.26%, comfortably positioning it in the top 40% of dividend stocks. To put this in perspective, the industry average for Insurance stocks is just 2.8%.

If you’re concerned about sustainability, worry not. The company’s forward payout ratio is a mere 40%, which is not only manageable but also closely aligned with the Insurance industry average of 30%. This means that the dividend payments are not only robust but also have room for future growth. Speaking of growth, the firm has a remarkable 15-year track record of dividend increases and is expected to continue this trend.

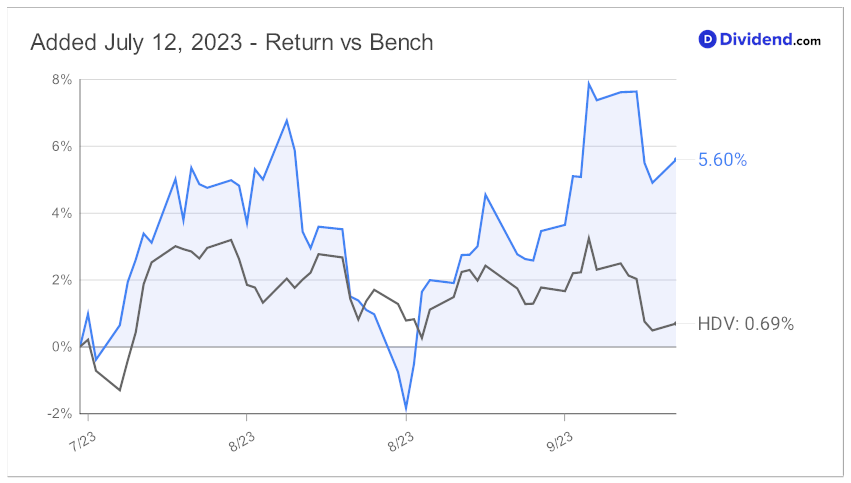

Since making it to this portfolio back in July, the stock has performed significantly better than the benchmark.

Now, mark your calendars because the next payout is just around the corner: an estimated $1.250 per share will be distributed on or around November 8. For those who value a blend of yield attractiveness and dividend safety, with a lesser focus on returns potential and returns risk, this stock stands out as a compelling choice.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 2, 2023.

Stay tuned for an in-depth stock analysis that delves deeper into these attributes, breaking down the financials and future prospects to help you make an informed investment decision.