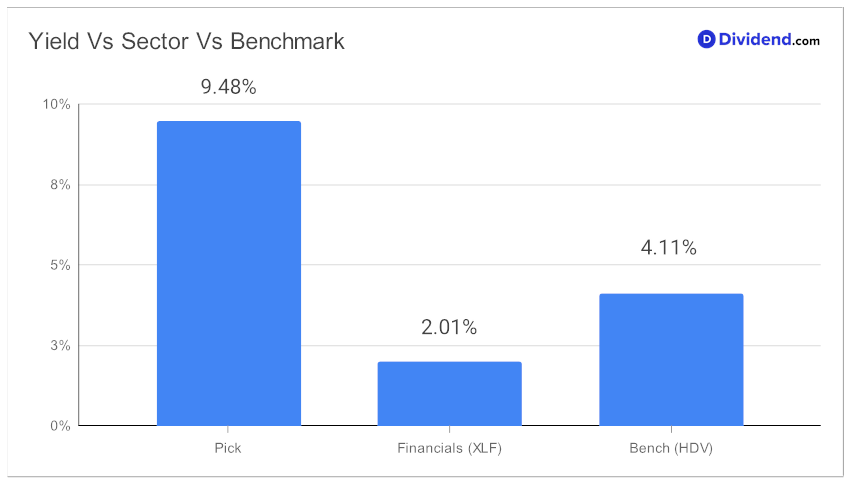

As savvy investors in pursuit of generous returns know, not all high-dividend stocks are created equal. It’s the rare find that combines a forward dividend yield that outpaces many peers—hovering impressively at nearly 9.5%—with the stability and performance that sidestep the notorious dividend traps. Indeed, such yields are not just generous; they’re meticulously curated, standing tall in the top echelons of dividend stocks.

Imagine a small-cap contender that mirrors the S&P 500’s and its own industry’s year-to-date return of 9%, signaling a consistency as reliable as the seasons. But it’s not just about what has passed; it’s about what lies directly ahead. With an estimated payout of $0.460 per share on the horizon, this player is poised to reward its shareholders imminently.

The selection process is stringent, prioritizing Yield Attractiveness and Dividend Safety while still giving a nod to Returns Potential and Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 3, 2023.

The upcoming detailed analysis will dive deeper, shedding light on why this particular opportunity has earned a coveted spot in the Best High Dividend Stocks model portfolio. Join us as we unwrap the layers of this financial opportunity, ripe for the picking as the next payout date approaches.