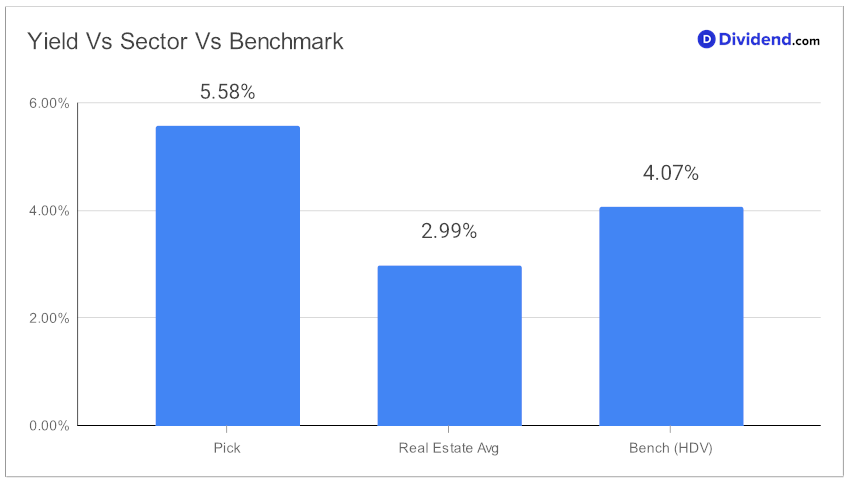

Investors seeking high dividend yields have a new opportunity to consider, as a small-cap eREIT has recently been added to the esteemed Best High Dividend Stocks model portfolio. This addition stands out in the realm of high dividend investments, especially noteworthy for those attuned to the eREIT industry. What makes this stock particularly appealing is its forward dividend yield of 5.58%, placing it in the top 20% of dividend stocks. This yield is not only considered high but also closely aligns with the eREIT industry average of 5.6%.

However, investors should approach with a degree of caution and be wary of potential dividend traps. The stock’s next payout is set to maintain its current rate at an unchanged non-qualified $0.205 per share. This dividend went ex-dividend on November 14, with a payment date scheduled for December 15.

The inclusion of this stock in the portfolio follows a rigorous recommendation process, emphasizing Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Returns Risk. This careful selection process ensures that only stocks meeting specific high standards are chosen. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 10, 2023.

For those interested in a more in-depth analysis of this promising eREIT, an extensive stock review follows, providing investors with a deeper insight into its potential as a high dividend investment.