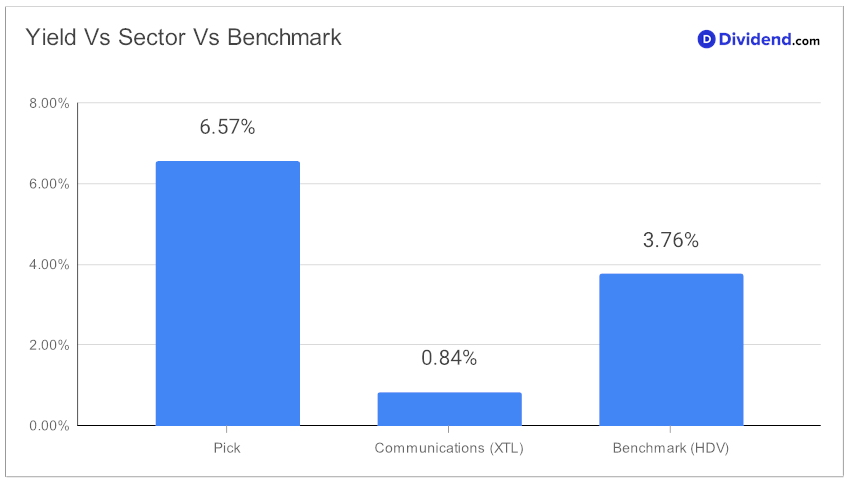

In the ever-evolving landscape of investment opportunities, discerning high dividend investors are continually on the lookout for robust, yield-generating stocks. Among these, a standout large-cap Telecom stock has recently been reaffirmed as a core holding in a prestigious model portfolio for its impressive dividend credentials. With a forward dividend yield of 6.57%, it not only surpasses the Telecom industry average of 5.6% but ranks in the coveted top 20% of high-yield dividend stocks, making it an attractive proposition for those seeking substantial income streams.

The stock’s commendable history of dividend increases extends over 15 years, placing it in the elite top 10% for consistency in enhancing shareholder value. Its low beta of 0.40 signals a lower correlation with broader equity market swings, offering a diversification advantage to investors’ portfolios. Moreover, with a year-to-date return of 9%, outperforming both the S&P 500 and its industry peers, it underscores the stock’s robust performance. It has even managed to beat this portfolio’s benchmark since making it to this list back in August 2023.

Part of the reason behind the recent strong performance can be attributed to its fourth quarter performance, wherein the company managed to show a reduction in spending on big projects and improve its competitive positioning in the industry. Addiitonally, 5G revolution is expected to increase data usage, which could improve our pick’s profit. This company has also managed to attract more home internet customers thanks to its fast broadband services, growing its customer base for five quarters in a row.

Investors should note the next payout is anticipated to be around $0.665 per share by March 1. This forthcoming distribution further highlights the stock’s appeal to those prioritizing income alongside growth. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 25, 2024.

For a deeper dive into how this stock aligns with criteria for Yield Attractiveness, Dividend Safety, and balanced considerations on Returns Potential and Risk, the following analysis offers an in-depth exploration, guiding investors toward making informed decisions in their pursuit of high dividend yields.