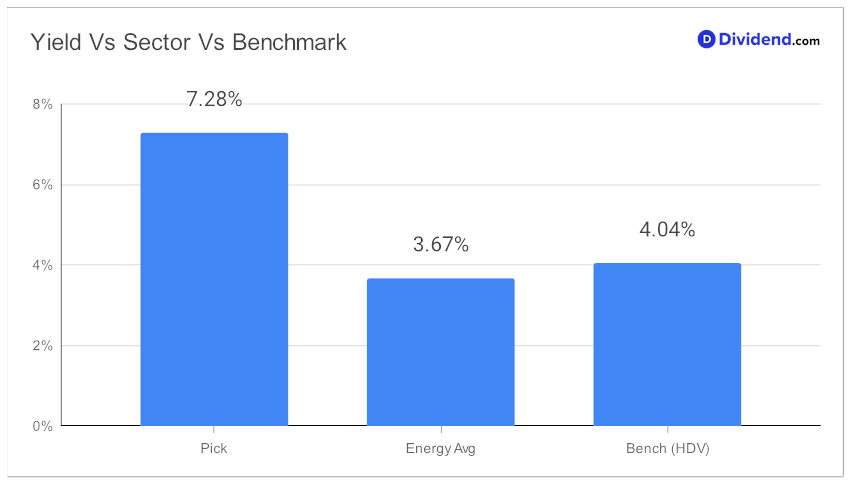

Attention high dividend investors! A well-covered mid-cap Energy MLP has been reaffirmed as a holding in the Best High Dividend Stocks model portfolio. This stock boasts a 7.28% forward dividend yield, ranking it in the top 20% of dividend stocks. While this yield is considered high, it’s important to be cautious of potential dividend traps. However, with a forward payout ratio of 47%, this stock aligns perfectly with the Energy MLP industry average, suggesting a sustainable dividend.

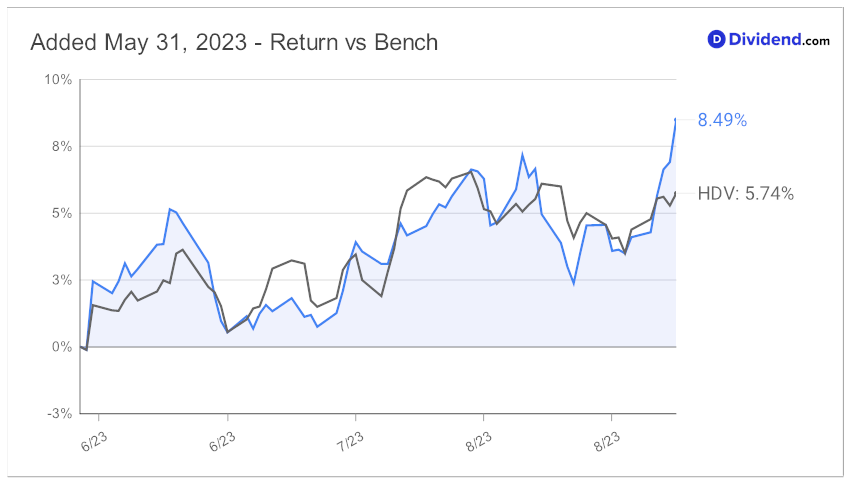

Year-to-date, this stock has returned 7%, slightly underperforming the S&P 500 and the Energy MLP industry, which have returned 19% and 9% respectively. However, since making it to the portfolio back in May 2023, the stock has managed to beat the portfolio benchmark by a decent margin.

The next payout is estimated at $0.842 per share, expected on or around October 25th.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 3, 2023.

This recommendation process optimizes for Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Returns Risk.

Stay tuned for an in-depth stock analysis that follows, providing a comprehensive understanding of this high-yield opportunity.