Attention high dividend investors! We’ve just added an exciting new holding to our Best High Dividend Stocks model portfolio, and it’s poised to deliver impressive returns. This well-covered small-cap Business Development Company (BDC) has caught our attention for all the right reasons.

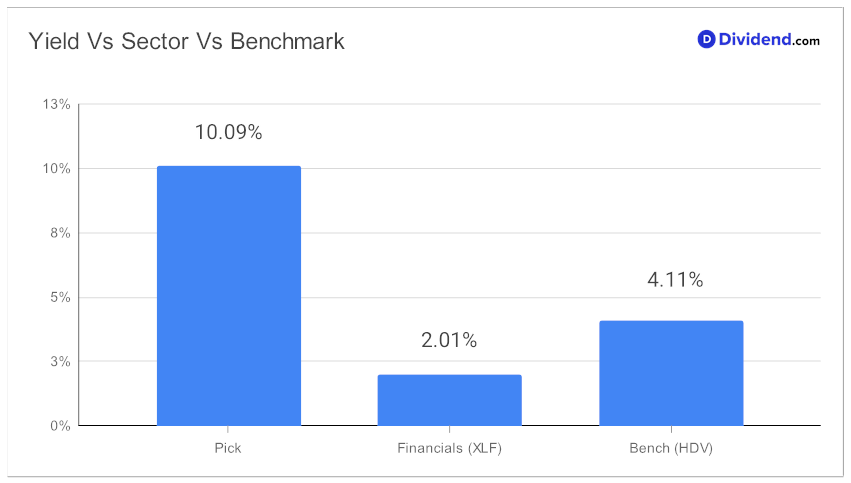

With a forward dividend yield of 10.09%, this stock ranks in the top 20% of all dividend stocks, making it a high-yield gem. But don’t worry about falling into a dividend trap – our analysis ensures your investment’s safety. While the BDC industry average stands at 11.0%, this stock has demonstrated a consistent 7-year dividend increase track record, ranking in the top 30% for dividend stocks, promising potential for future increases.

A 10% 3-year dividend per share compound annual growth rate (CAGR) places this stock in the top 40% of all dividend stocks, indicating sustained financial strength. Notably, it has outperformed the S&P 500, delivering an impressive 30% return year-to-date, compared to just 15% for the market benchmark and 14% for the BDC industry.

On September 29, the company paid out its regular dividend of $0.56 per share along with a supplemental dividend of $0.06 per share.

Stay tuned for our in-depth stock analysis, where we’ll delve deeper into the potential of this high-yield, low-risk investment opportunity. While arriving at our recommendation, we have also taken into account the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on August 7, 2023.

Don’t miss out on the chance to supercharge your dividend portfolio!