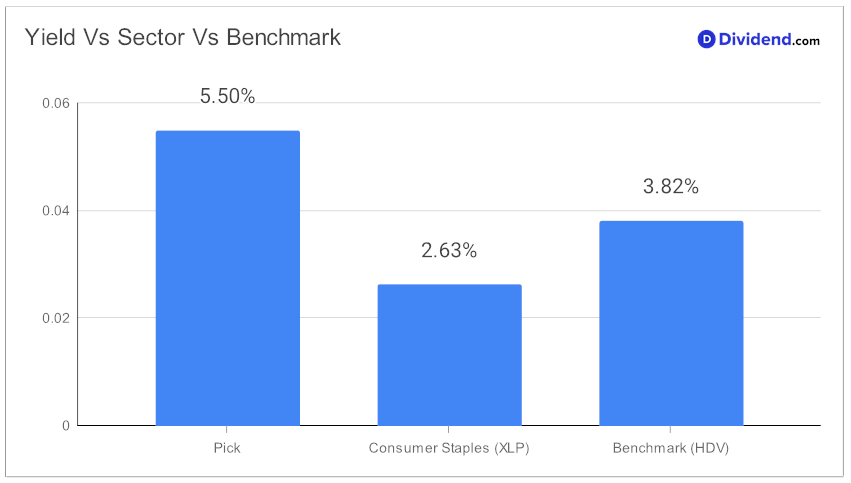

In the realm of high dividend investing, a large-cap stock in the Consumer Products sector stands out as a robust choice for those seeking a blend of yield attractiveness and dividend safety. With a forward dividend yield of 5.50%, it ranks in the top 20% of dividend stocks, significantly surpassing the industry average of 3.0%. This figure not only represents a high yield but also a beacon of reliability, given its 16-year track record of dividend increases, a feat placing it in the top 10% of dividend stocks.

Investors looking for portfolio diversification will appreciate its 0.70 beta, indicating lower correlation with equity market fluctuations. In terms of performance, this stock has demonstrated resilience, returning 1% year-to-date, aligning with the Consumer Products industry and outperforming the S&P 500’s stagnant growth.

The next payout, estimated at $1.300 per share, is anticipated around March 8, reflecting the company’s consistent commitment to rewarding its shareholders. This payout is not just a transaction; it’s a testament to the company’s stable financial health and a preview of what our in-depth analysis will further reveal. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 20, 2023.

Stay tuned for a comprehensive examination of its potential in the high dividend investment landscape.