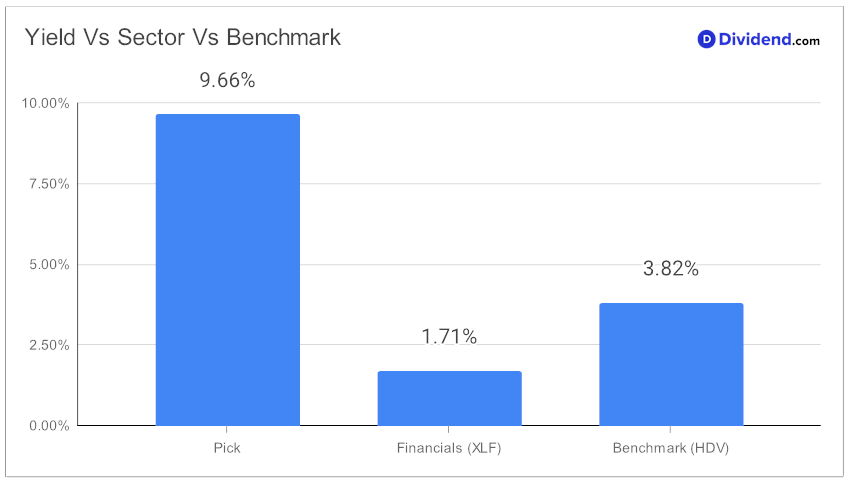

Investors seeking high dividend yields, take note! A mid-cap Business Development Company (BDC) has recently been added to the prestigious Best High Dividend Stocks model portfolio. This inclusion marks a significant development for investors focused on high dividend yields. The stock boasts a forward dividend yield of 9.66%, placing it in the elite top 20% of dividend stocks. However, it’s essential to approach high yields with caution to avoid potential dividend traps, especially given that the BDC industry average yield is slightly higher at 10.4%.

Further enhancing its appeal, the stock shows a robust 3-year dividend per share compound annual growth rate (CAGR) of 8%, ranking it favorably in the top 40% of all dividend stocks. What’s more, its beta of 0.62 indicates a lower correlation with equity market fluctuations, providing a diversified addition to an equity portfolio.

The next anticipated payout is a noteworthy $0.370 per share, expected on or around February 7th, presenting a timely opportunity for dividend investors.

This selection aligns with a strategic investment approach that prioritizes Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on November 22, 2023.

For a more comprehensive analysis, an in-depth stock evaluation follows, offering insights into the unique attributes of this high-yield investment option.