Are you in pursuit of a high dividend investment opportunity that isn’t just a flash in the pan? Our Best High Dividend Stocks model portfolio has just added a robust player in the insurance sector, recognized for its healthy dividend yield and sustained track record of increases.

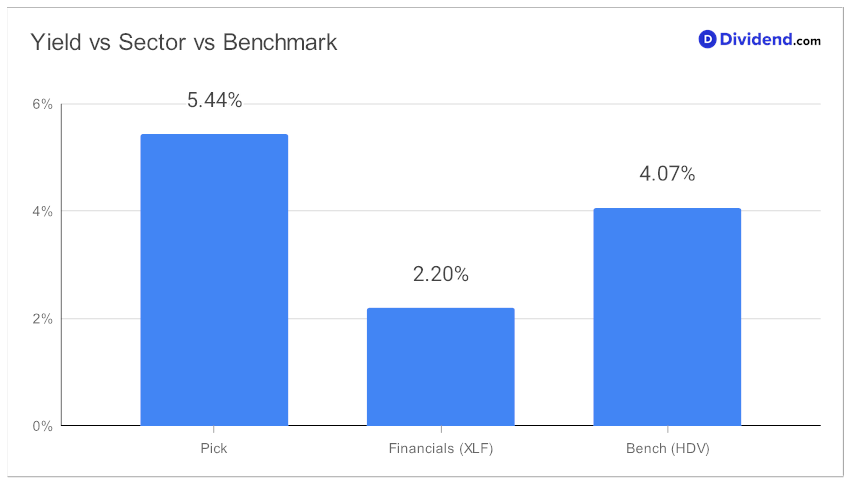

With a forward dividend yield of 5.44%—almost double the industry average—this company comfortably sits in the top echelon of high-yield dividend stocks.

Its low forward payout ratio of 40% aligns with sector norms, ensuring the sustainability of dividends, while a 15-year track record of dividend increases signifies reliability.

Prepare for the next windfall with an anticipated payout of $1.250 per share around August 9.

Our selection process, optimizing for Yield Attractiveness and Dividend Safety, is designed to minimize risk while maximizing return potential. Keep reading for an in-depth analysis of this dividend powerhouse that’s both solid and profitable.