In the dynamic world of dividend investing, a prominent player in the Health Care sector has recently garnered attention for its remarkable performance and stable dividends. With a forward dividend yield of 3.82%, this stock stands out in its industry, surpassing many of its peers and closely matching the Biotech/Pharma industry average of 4.0%. Its stability and appeal are further bolstered by an impressive 50+ year track record of consistent dividend increases, placing it in the top echelon of dividend stocks.

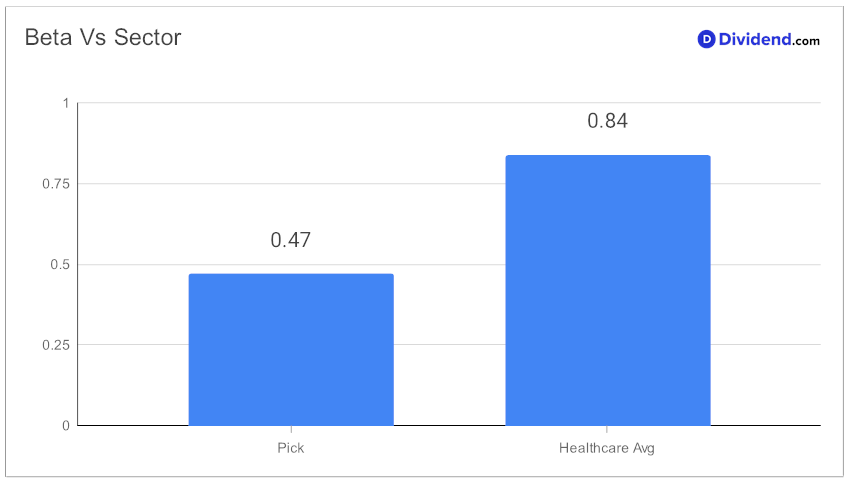

Beyond its dividend merits, the stock demonstrates a unique resilience in market fluctuations, as evidenced by its low beta of 0.47. This characteristic indicates a low correlation with equity market movements, offering a diversified and potentially safer investment option within an equity portfolio. Its performance this year further underscores its robustness, delivering a 5% return, contrasting favorably against the S&P 500’s -2% and aligning with the Biotech/Pharma industry’s average.

Looking ahead, investors are eyeing the next significant event: a 4.7% increase in its qualified dividend, amounting to $1.550 per share. This upcoming payout, going ex-dividend on January 12, represents not only an immediate opportunity for shareholders but also a testament to the company’s financial health and commitment to shareholder value. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 27, 2023.

This analysis serves as a precursor to a more in-depth exploration of the stock, focusing on an optimal blend of yield, dividend safety, return potential, and risk, specifically tailored for Health Care dividend stocks.