In the dynamic world of dividend investing, a new addition to the Best Sector Dividend Stocks model portfolio stands out for its stability and impressive track record.

This large-cap Medical Devices stock is a beacon for balanced dividend investors, boasting a remarkable history of dividend increases. With a 40+ year streak of consistent dividend growth, it ranks in the top 10% of all dividend stocks, signaling robust financial health and a commitment to shareholder returns.

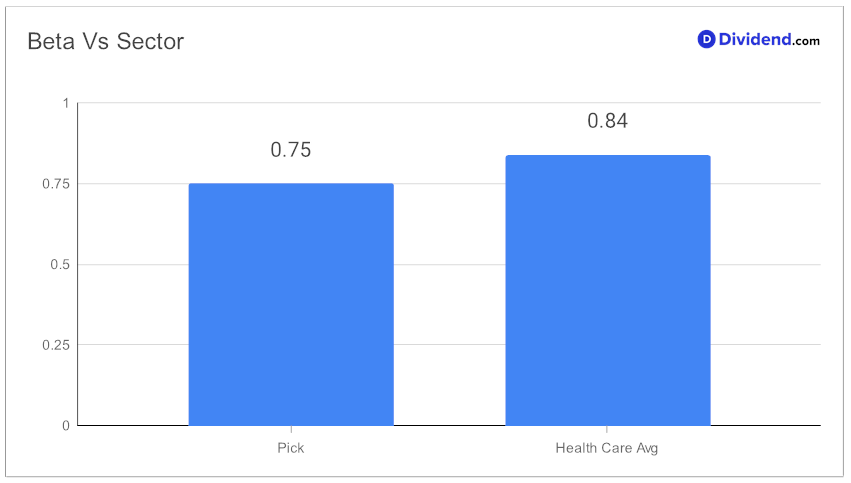

But what makes this stock especially intriguing is its low correlation with the equity markets. With a beta of 0.75, its monthly returns show a lesser tie to market fluctuations, offering a diversification edge for an equity portfolio. This aspect is particularly appealing for investors seeking a mix of yield, dividend safety, returns potential, and controlled risk, specifically within the Health Care sector.

After witnessing stagnating growth in recent years, our pick is likely to benefit from transformation initiatives focused on increasing efficiencies and investing in high-growth areas like AI and robotics.

Management’s commitment to transforming the business is evident from mid-single-digit percentage revenue growth over the past four quarters. Its commitment to growing dividends coupled with an improving outlook are reasons for excitement for income investors.

Accordingly, investors should note the upcoming dividend payout, estimated at $0.690 per share, expected on or around December 8. This imminent distribution underscores the stock’s reliability as a dividend payer.

For a deeper dive into why this stock has been chosen for the model portfolio and how it aligns with an optimized blend of yield and safety, the full analysis awaits, offering detailed insights for those looking to fortify their investment strategy with a solid, dividend-paying stock in the health care sector. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on November 21, 2023.