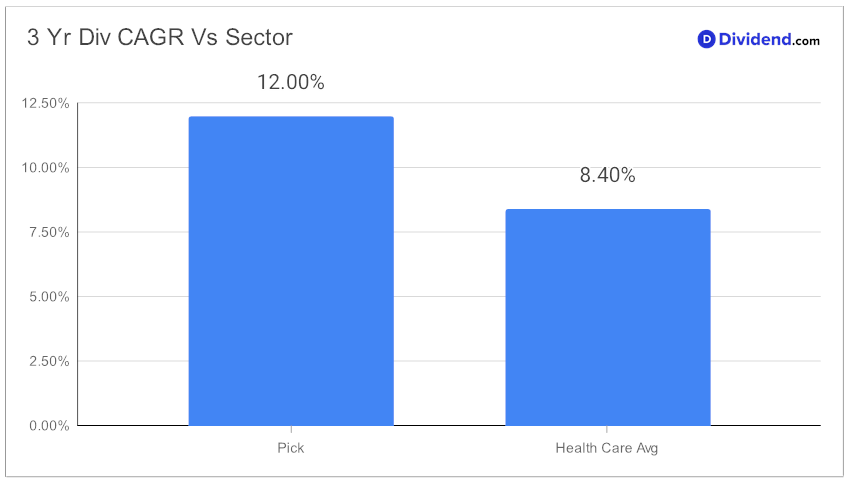

In the ever-evolving landscape of the healthcare sector, discerning investors are constantly on the lookout for stocks that not only promise stability but also offer attractive dividend yields. Among the plethora of options, a particular large-cap Health Care Facilities Services stock stands out, not just for its impressive performance but also for its strategic positioning within the Best Sector Dividend Stocks model portfolio. With a forward payout ratio of 18%, closely aligning with the industry average, this stock showcases a prudent balance between dividend safety and growth potential. The 12% three-year dividend compound annual growth rate places it in the esteemed top 40% of all dividend stocks, underscoring its commendable growth trajectory.

Moreover, its low beta of 0.52 indicates minimal correlation with broader equity market fluctuations, presenting a valuable diversification tool for investors’ portfolios.

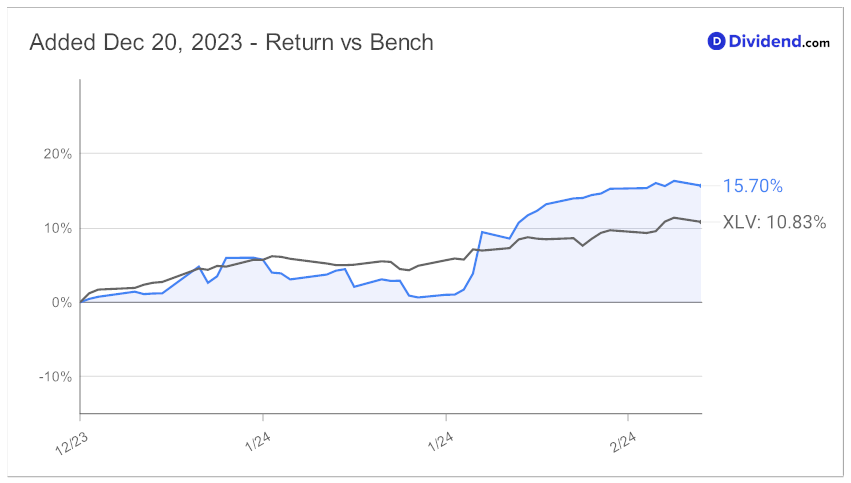

The stock’s year-to-date return of 14% notably outpaces both the S&P 500 and its industry counterparts, highlighting its robust performance. Additionally, since making it to this list back in December, the stock has managed to stay ahead of the benchmark.

Investors should take note of the upcoming dividend payout, which marks a 13.8% increase to $1.400 per share, going ex-dividend next Tuesday. This pivotal moment offers a unique opportunity for investors seeking a harmonious blend of yield, safety, and growth potential in the healthcare dividend stock space.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 2, 2024. The global healthcare services provider reported a strong financial performance for 2023, with significant revenue growth and operational success across its key business segments. With a focus on core business areas, while deciding to sell out its Medicare business, the company currently has an optimistic outlook on earnings per share, revenue and dividend growth.

The following in-depth analysis will delve deeper into its merits, laying out a compelling case for its inclusion in a balanced dividend investment strategy.