Exciting news for balanced dividend investors! A well-covered large-cap Biotech/Pharma stock has been added to the Best Sector Dividend Stocks model portfolio. With a robust forward dividend yield of 3.88%, this new addition ranks in the top 40% of dividend stocks, slightly below the industry average of 4.1%.

What’s more compelling is the stock’s forward payout ratio of 43%. This low-enough ratio aligns closely with the Biotech/Pharma industry average of 37%, suggesting a sustainable dividend payout in the foreseeable future. An 8-year track record of dividend increases puts this stock in the top 30% of dividend stocks, signaling favorable prospects for future dividend hikes.

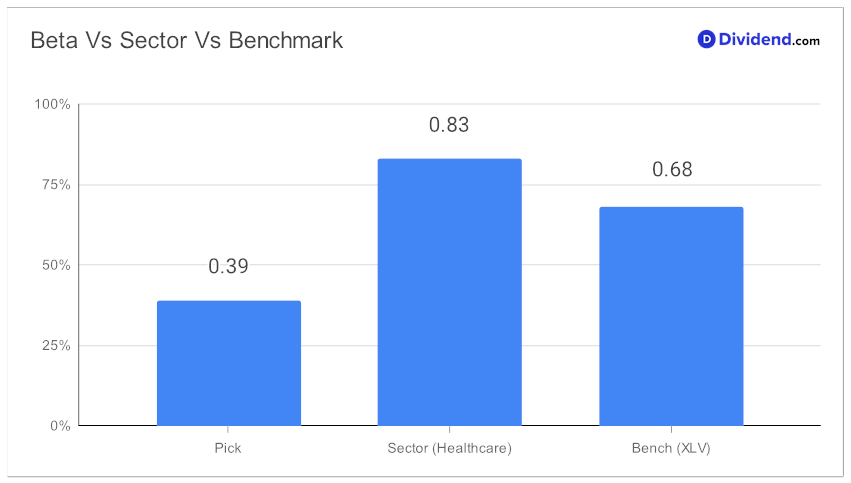

If you’re looking to diversify, the stock’s beta of 0.39 indicates that its monthly returns are minimally correlated with the broader equity markets. It’s an ideal candidate for reducing portfolio risk.

Today is especially noteworthy as the stock is going ex-dividend with an unchanged qualified payout of $0.750 per share.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 3, 2023.

Stay tuned for the in-depth stock analysis that follows, focusing on optimizing an equal blend of yield, dividend safety, returns potential, and risk among Health Care dividend stocks.

This carefully curated addition to the portfolio is not to be missed!