In the ever-evolving landscape of dividend investing, a new star emerges within the Health Care sector, offering a unique blend of stability and growth potential. This mega-cap Biotech/Pharma stock stands out with its impressive 60+ year track record of dividend increases, placing it in the top echelon of dividend stocks. What’s more, the expectation of continued increases adds a layer of future security for investors.

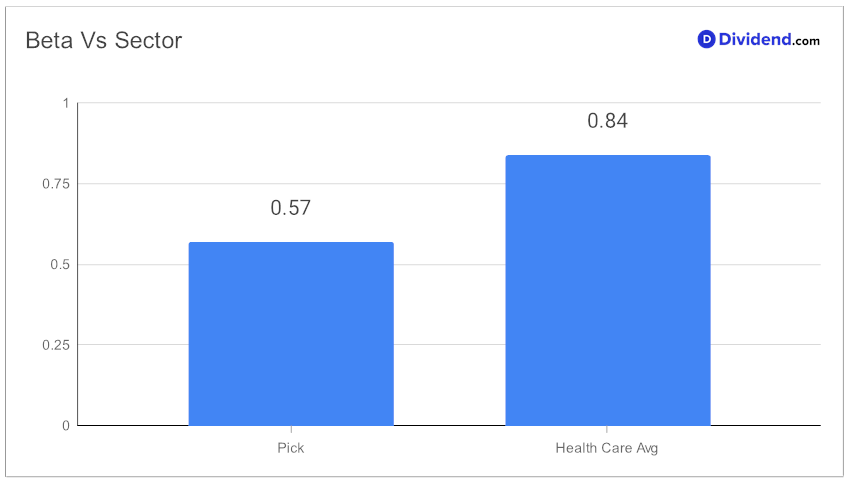

The stock’s resilience is further underscored by its low beta of 0.57, indicating minimal correlation with broader equity market fluctuations. This characteristic makes it a prime candidate for diversifying an equity portfolio, offering a steadier return profile in turbulent times.

For investors seeking regular income, the stock’s next payout is a key attraction. An estimated dividend of $1.190 per share is anticipated around January 4, making it an immediate point of interest.

This inclusion in the Best Sector Dividend Stocks model portfolio follows a rigorous selection process. The portfolio is finely tuned to optimize for an equal blend of yield, dividend safety, returns potential, and risk, specifically within the Health Care dividend stock universe. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 17, 2023.

The following in-depth analysis will delve deeper into the stock’s performance, dividend sustainability, and its role in a balanced dividend investment strategy. This is an opportunity for investors to gain comprehensive insights into one of the most promising dividend stocks in the health care sector.