In the intricate dance of dividend investing, balancing the quest for yield with the poise of safety is an art. Enter the latest ensemble member of the Best Sector Dividend Stocks model portfolio—a beacon of stability in the tumultuous biotech/pharma sector. With an 11-year crescendo of dividend increases, this large-cap contender not only sings a tune of consistency but also boasts a top 10% ranking among its dividend-dispensing peers.

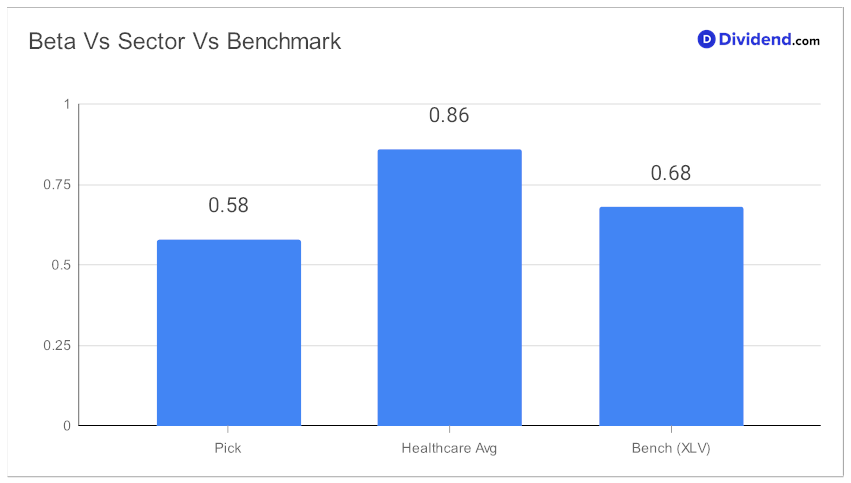

As we peel back the layers, the numbers orchestrate an enticing symphony: a 10% 3-year dividend compound annual growth rate places it in the illustrious top 40%, while a modest 0.58 beta hints at a harmonious diversification benefit to your equity portfolio, dancing to its own rhythm rather than following the broader market’s fluctuations.

Despite a subdued year-to-date performance, falling slightly behind the market benchmarks, the upcoming payout remains a steadfast, qualified $2.130 per share, going ex-dividend on the 16th of November. For those attuned to the finer details of portfolio composition, this addition could be the next strategic move in fine-tuning your investment symphony. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 1, 2023.

Stay tuned for an in-depth analysis that will unravel the layers of this promising stock, resonating with balanced investors who harmonize yield with prudent risk management.