In the dynamic world of dividend investing, a notable mid-cap banking stock has recently caught the attention of savvy investors. This addition to the Best Sector Dividend Stocks model portfolio stands out for its compelling blend of yield, dividend safety, and return potential, particularly within the financial sector.

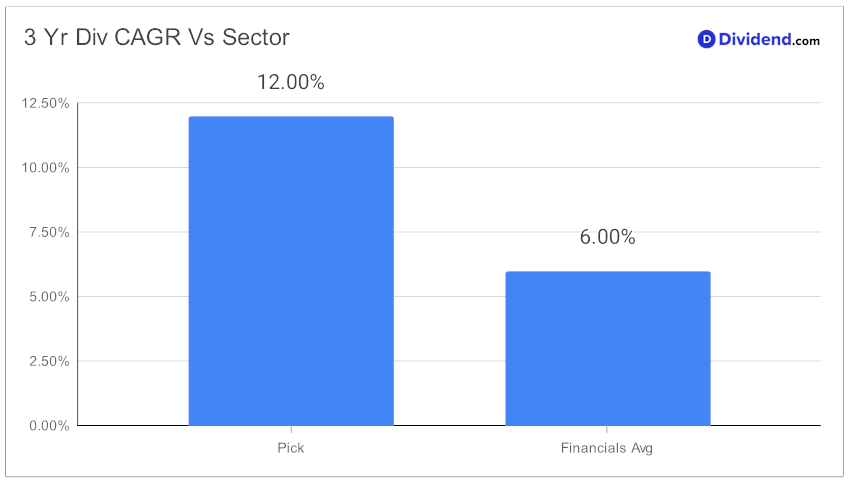

Key metrics underscore its appeal: a conservative 23% forward payout ratio aligns closely with the banking industry average, yet this stock manages to distinguish itself. Its 12% three-year dividend per share compound annual growth rate (CAGR) places it in the top echelon of all dividend stocks, signaling robust growth prospects. In terms of year-to-date performance, it has outpaced both the S&P 500 and its banking industry counterparts, delivering an 8% return compared to their more modest 2% and 1%, respectively.

Looking ahead, investors can anticipate a payout estimated at $0.620 per share around February 28. This next dividend installment is not just a testament to the stock’s steady income generation but also reflects the underlying financial strength and commitment to shareholder returns.

This overview only scratches the surface. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 27, 2024.

An in-depth analysis follows, delving deeper into the strategic positioning and future outlook of this banking stock, a promising choice for balanced dividend investors seeking a harmonious mix of safety and growth potential.