In the dynamic world of dividend investing, a standout mid-cap insurance stock is making waves, promising a blend of steady income and growth potential. This financial gem boasts a modest 18% forward payout ratio, aligning closely with the industry’s average, yet offering a much more tantalizing prospect for balanced dividend investors. What sets it apart? A remarkable 22-year history of dividend increases, placing it in the elite top 10% of dividend stocks, with a bright forecast for future growth.

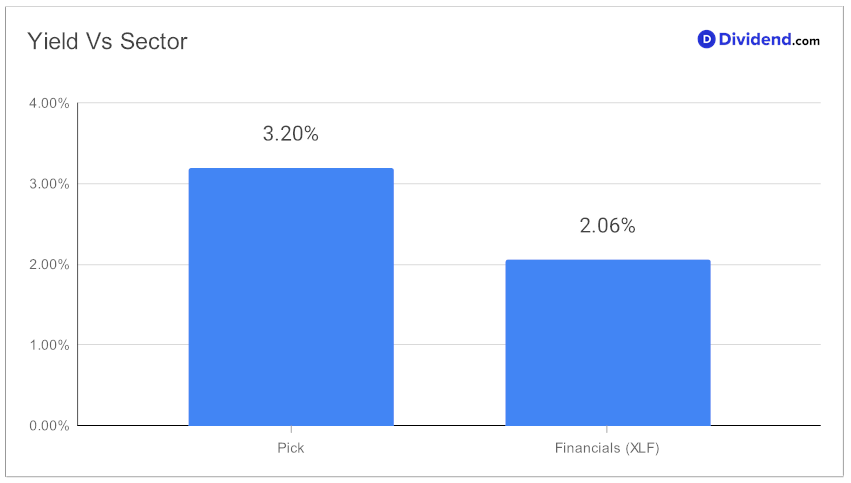

The real catch, however, is the upcoming dividend payout. Investors can anticipate a generous $0.440 per share distribution around December 8, a testament to the company’s robust financial health and commitment to shareholder returns. The stock currently yields 3.2%, significantly higher than that of the financial sector average.

This isn’t just a one-off event; it’s part of a carefully optimized strategy focusing on yield, dividend safety, return potential, and risk, specifically tailored for those investing in Financials dividend stocks.

Our in-depth analysis dives deeper, revealing the nuances of this investment opportunity. We dissect the factors that make this stock a compelling addition to any balanced dividend portfolio, balancing the excitement of potential returns with the prudence of risk management. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 3, 2023.