In the ever-evolving landscape of dividend investing, balanced investors continually seek assets that promise stability, growth, and noteworthy shareholder returns. Enter a standout performer in the Insurance sector: a mid-cap marvel not just surviving but thriving in this competitive arena. With a forward payout ratio of a mere 21%, significantly lower than the industry’s average, it exemplifies dividend safety and commitment to income-oriented shareholders.

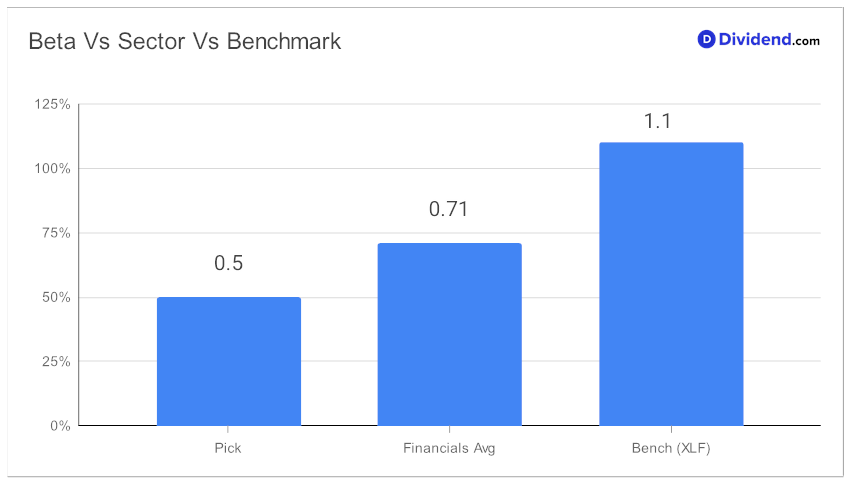

This financial stalwart isn’t new to the game, boasting an 18-year streak of dividend increases that places it in the elite top 10% of dividend stocks. Its consistency signals not just past triumphs but also a promising horizon of future hikes. Add a 0.50 beta into the mix, and you have a stock that stands firm against market volatility, offering much-needed portfolio diversification.

Year-to-date returns are impressive, outperforming the S&P 500 and leaving others in its industry in the dust. With an upcoming payout estimated at $0.700 per share around November 10th, investors have a tangible, near-term benefit on the table.

But what makes this stock a worthy contender for your portfolio? Delve into our comprehensive analysis to unpack its potential, exploring facets beyond mere numbers. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 2, 2023.

Within the confines of Financials, our recommendation reflects a meticulous optimization process, balancing yield, dividend safety, return potential, and risk, exclusively for discerning investors like you. Join us as we unravel the layers of this opportunity, steering through the nuanced pathways of strategic dividend investing.