In the realm of dividend investing, where stability meets growth, a notable large-cap Insurance stock has recently been added to the Best Sector Dividend Stocks model portfolio. This addition marks a significant move for balanced dividend investors seeking a blend of yield, dividend safety, and potential returns.

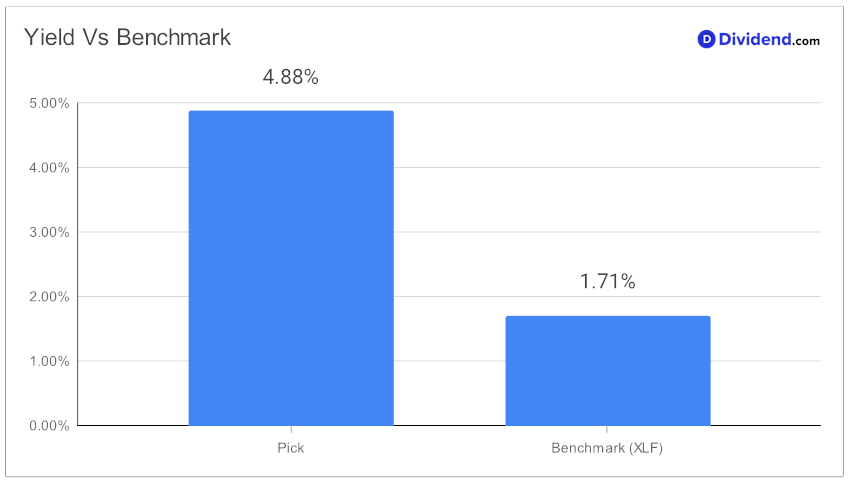

This stock stands out with its impressive 4.88% forward dividend yield, surpassing the industry average of 2.8%. Not only does this place it in the top 40% of dividend stocks for yield, but it also demonstrates a robust financial standing. Moreover, the stock’s 36% forward payout ratio aligns well with the industry average, ensuring that dividend payouts are sustainable and not overextending the company’s finances.

A key highlight is its 15-year track record of dividend increases, placing it in the top 10% of dividend stocks. This history not only speaks to its financial resilience but also signals the likelihood of future dividend growth. Investors can look forward to the next payout, estimated at $1.250 per share, anticipated around February 7.

This intriguing addition to the portfolio is not just about immediate returns. It is part of a strategic approach to optimize investment in Financials dividend stocks, balancing yield, safety, and growth potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 2, 2023.

For those keen on understanding the finer details of this investment opportunity, an in-depth stock analysis follows, offering a deeper dive into the stock’s performance, market position, and future prospects.