For balanced dividend investors seeking a blend of yield, safety, and growth, a prominent addition has been made to the Best Sector Dividend Stocks model portfolio. This well-covered large-cap Asset Management stock brings a robust history of success, ranking in the top 10% of dividend stocks with a 14-year track record of dividend increases.

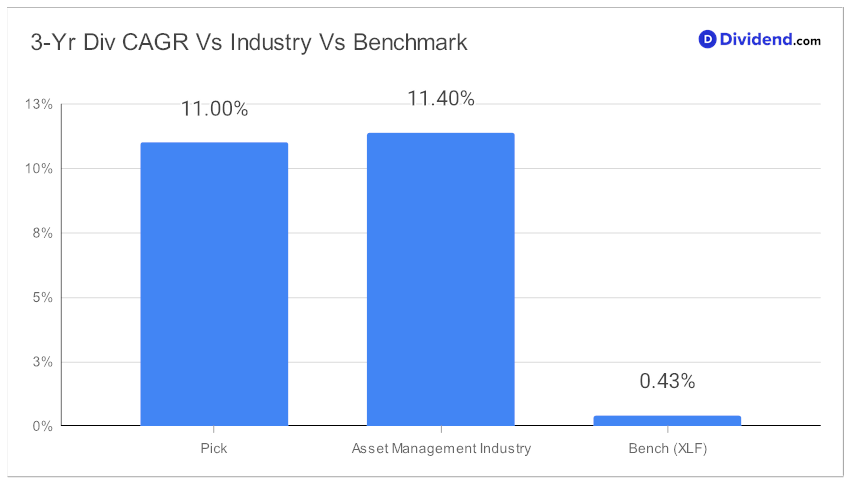

It stands out in the top 40% of all dividend stocks with an 11% 3-year dividend per share compound annual growth rate.

Moreover, investors can look forward to an unchanged qualified $5.000 per share payout going ex-dividend on September 7.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on July 15, 2023.

With the objective of optimizing an equal blend of yield, dividend safety, returns potential, and risk among Financials dividend stocks, this holding symbolizes a strategic move.

Read on for an in-depth stock analysis that elucidates the rationale behind this selection and uncovers the opportunities it offers.