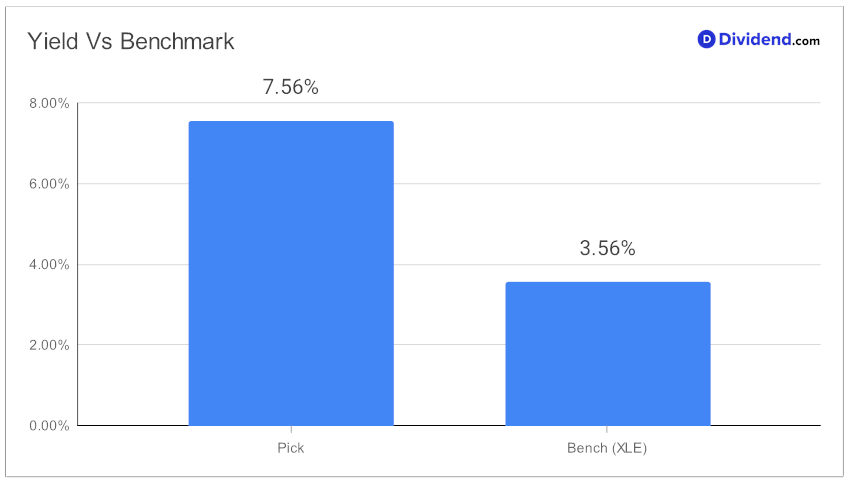

In the dynamic world of dividend investing, balance is key. Our latest model portfolio update shines a spotlight on a standout performer in the Energy MLP sector. This large-cap entity boasts a formidable 7.56% forward dividend yield, surpassing the industry average of 6.8% and positioning it in the top echelon of high-yield stocks. However, savvy investors know to tread carefully around high yields to avoid potential traps.

But there’s more to this story. The company’s impressive 25+ year streak of dividend increases places it in the top 10% for consistency, signaling a reliable income stream for investors. It’s not just about past performance, though; expectations of future increases add to its appeal.

Year-to-date, it has delivered an 18% return, keeping pace with the broader S&P 500 and slightly trailing its industry peers. This context is crucial for balanced dividend investors seeking an optimal mix of yield, safety, and potential returns within the Energy sector.

The next payout, estimated at $0.500 per share, is anticipated around January 5. This imminent distribution is a tangible reminder of the investment’s income-generating potential.

Our in-depth analysis delves deeper into the company’s financial health, dividend sustainability, and growth prospects, providing a comprehensive picture for investors looking to make informed decisions in this specific sector. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 5, 2023.