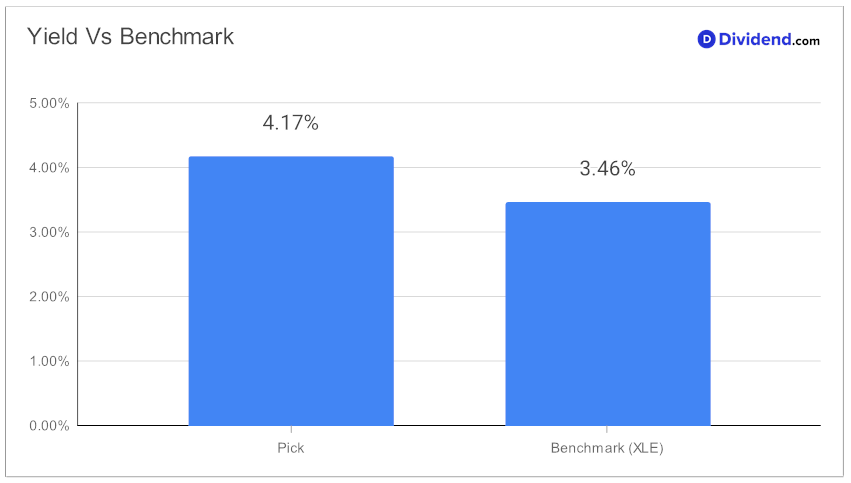

In the dynamic world of dividend investing, finding a gem that not only offers a solid return but also stands as a testament to reliability and growth is paramount. One such well-covered mega-cap stock in the Energy sector has once again solidified its position in the Best Sector Dividend Stocks model portfolio, marking itself as an essential holding for balanced dividend investors. With a forward dividend yield of 4.17% that outperforms the industry average, sitting comfortably in the top 40%, it presents an attractive proposition for those seeking good yield. Remarkably, this stock boasts a 30+ year history of dividend increases, a consistency placing it in the elite top 10% of dividend stocks, with expectations of future growth continuing this impressive trend.

Year-to-date, the stock has demonstrated resilience and performance with a 5% return, navigating the volatile energy market with strategic prowess, though trailing slightly behind the broader Oil/Gas/Coal industry and S&P 500 indices. The anticipation builds towards the next payout, estimated at $1.630 per share, expected on or around April 26, reflecting the stock’s ongoing commitment to rewarding its investors.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 03 Feb, 2024. The energy corporation reported solid financial results for 2023, achieving a record Return on Capital Employed (ROCE) and significant returns to shareholders in a volatile market. The company emphasized its strategic focus on capital efficiency, cost management, and integrating strategic acquisitions, notably enhancing its operational footprint in the Permian Basin. Amidst challenging geopolitical and economic conditions, the management highlighted a disciplined approach to investing in growth while maintaining financial strength, allowing for an 8% increase in dividends.

Future outlook includes navigating potential production impacts from environmental factors and continuing shareholder return programs. The company’s strategic investments and operational excellence aim to sustain growth and efficiency, addressing both current challenges and future opportunities in the energy sector.

This brief overview only scratches the surface of the comprehensive analysis that follows, delving deeper into the metrics that underscore this stock’s standing. By prioritizing an equal blend of yield, dividend safety, returns potential, and risk within the Energy sector, this in-depth examination aims to provide investors with the insights needed to make informed decisions in the ever-evolving landscape of dividend investing.