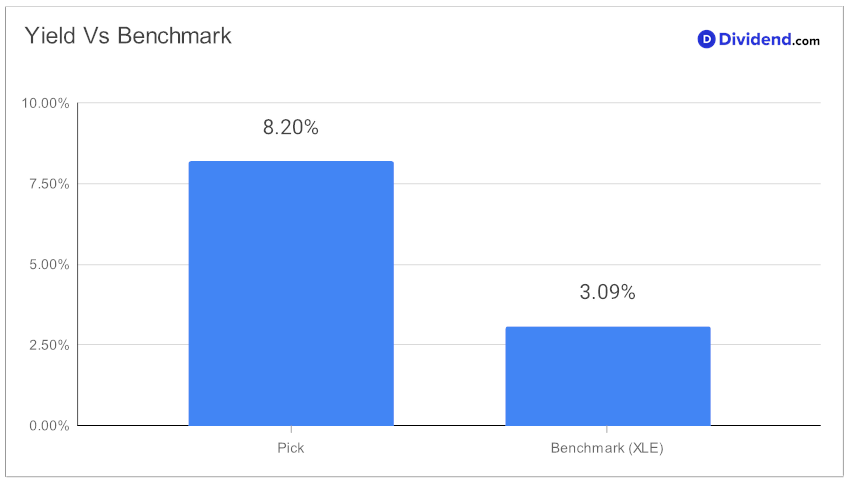

In today’s financial landscape, discerning investors often seek stable returns coupled with reliable income. A prime example lies within the Energy MLP sector, characterized by a significant entity that stands out with an 8.20% forward dividend yield. This figure not only surpasses the industry average of 6.4% but also positions it in the top 20% of dividend-paying stocks. Such a high yield necessitates vigilance to avoid dividend traps, highlighting the importance of thorough stock evaluations.

Moreover, this entity showcases a robust track record with a decade of consistent dividend increases, placing it in the favorable top 30% among dividend stocks. Its performance this year also impresses, with a 15% return, outpacing both the S&P 500 and its industry peers. This demonstrates its resilience and appeal in a fluctuating market.

Looking ahead, investors should note the upcoming dividend payment estimated at $0.850 per share, scheduled for around April 25. This next payout is not just a mere transaction; it’s a testament to the entity’s enduring commitment to shareholder value.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 31 Jan, 2024. The energy infrastructure and logistics company reported solid growth and financial performance for the year, driven by operational efficiency and strategic investments across its business segments. The company highlighted significant operational achievements, particularly in its logistics and storage, and gathering and processing segments, fueled by robust customer demand and capital investments.

An optimistic long-term outlook was shared, based on continued demand for hydrocarbons, with strategic acquisitions and a disciplined capital expenditure plan targeting growth. Financially, the company continues to demonstrate robust trends in earnings, distributable cash flow, and commitment to returning capital to unitholders.

Our in-depth analysis delves deeper into these aspects, assessing not only the attractive yield and historical performance but also evaluating dividend safety, return potential, and risk. Our balanced approach ensures that investors are well-informed to make decisions that align with both their financial goals and risk tolerance. Stay tuned for a comprehensive exploration of what makes this stock a cornerstone in any balanced dividend investor’s portfolio.