In the realm of energy sector investments, a standout has consistently illuminated the path for balanced dividend investors. This mega-cap entity in the oil and gas domain offers an appealing proposition, blending stability with growth. With a modest forward payout ratio of 41%, closely aligned with the industry average, it showcases a balanced approach to shareholder returns and reinvestment. Notably, its dividend history speaks volumes, boasting a nearly 40-year streak of increases—a testament to its resilience and commitment to investors, placing it in the top echelon of dividend stocks.

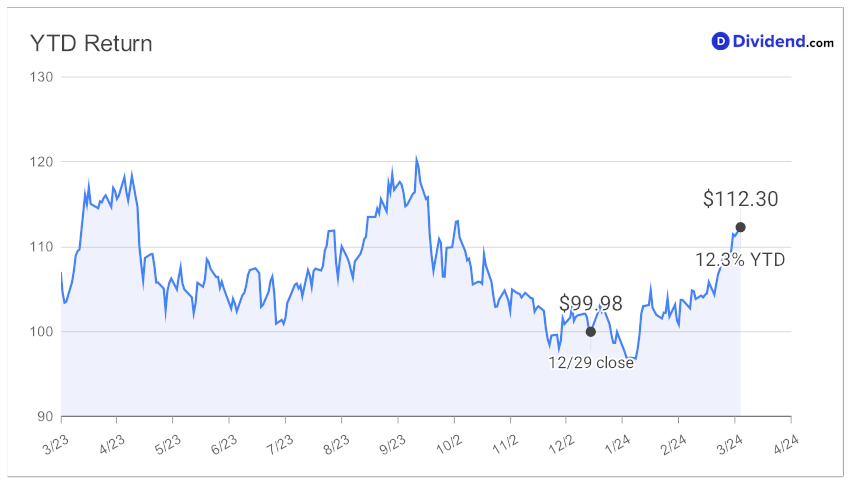

Year-to-date, this stock has outshined, delivering a 12% return, eclipsing the broader market’s performance, and leading its industry peers.

As we edge closer to the next payout, estimated at $0.95 per share around April 26, investors are poised for another rewarding moment.

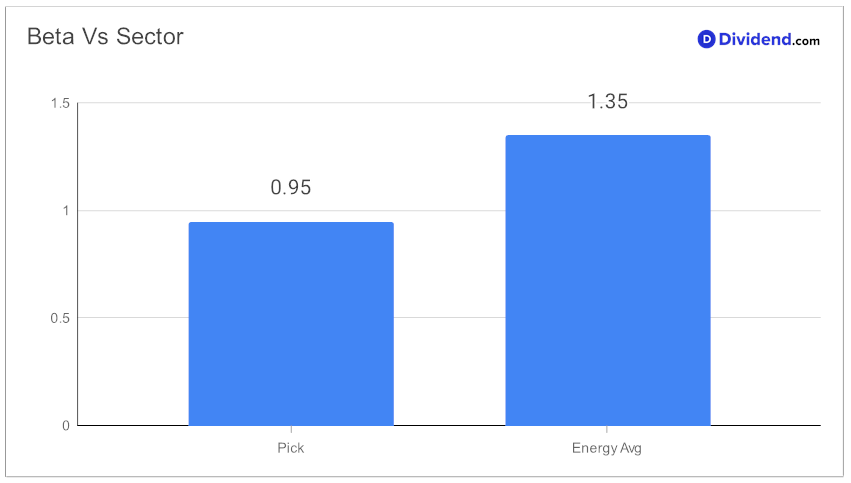

Additionally, the stock features a beta of 0.95, indicating nearly inline fluctuations with the broader market but showing less volatility compared to its peer group.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 02 Feb, 2024. The global energy company reported a highly successful year, marked by strategic asset optimization, advancements in safety, and significant financial achievements. The management emphasized the company’s strong commitment to safety, surpassing industry benchmarks, and its focus on innovation in low-carbon solutions, including entering the lithium business and carbon capture technology. Financially, the year was highlighted by $36 billion in earnings and a 15% return on capital employed.

Looking ahead, the company plans substantial investments in low-cost supply assets and low-carbon initiatives, aiming for structural cost savings and enhanced product mixes. The discussion reflected confidence in continued growth and leadership in the energy sector, with a commitment to delivering shareholder value through consistent performance and strategic expansions.

This firm’s selection in the Best Sector Dividend Stocks model portfolio comes after a rigorous analysis, focusing on yield, dividend safety, return potential, and risk, tailored exclusively for the energy sector. This in-depth analysis underscores the stock’s exemplary standing, offering a beacon for those navigating the complex terrain of dividend investing.