Are you a balanced dividend investor seeking a well-covered large-cap stock in the Oil/Gas/Coal sector? Look no further. This stock has a low forward payout ratio of 28%, which is in line with the industry average of 37%. This suggests a sustainable dividend policy, which is further supported by a 6-year track record of dividend increases, placing it in the top 30% of all dividend stocks.

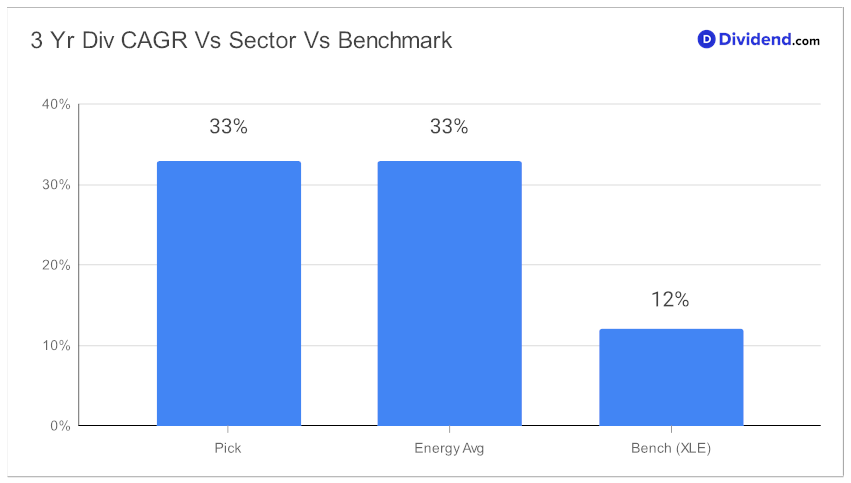

Moreover, its 3-year dividend per share compound annual growth rate (CAGR) of 33% ranks in the top 20% of all dividend stocks, indicating a strong potential for future growth.

Despite a modest year-to-date return of 3%, compared to 19% for the S&P 500 and 4% for the Oil/Gas/Coal industry, the stock’s next payout remains unchanged at a qualified $0.825 per share, going ex-dividend on October 16.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 5, 2023.

This stock is a perfect blend of yield, dividend safety, returns potential, and risk, making it a solid choice for balanced dividend investors.

Stay tuned for an in-depth stock analysis that follows, providing further insights into this promising investment opportunity.