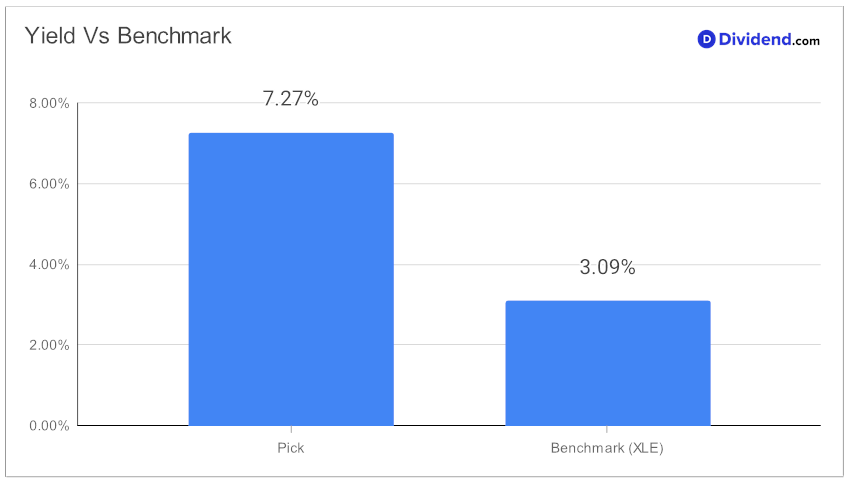

In the realm of dividend investing, discerning where to allocate assets involves navigating a landscape rich with opportunity yet fraught with pitfalls. One particular Energy MLP stands out, boasting a forward dividend yield of 7.27%—surpassing the industry average of 6.5% and positioning itself in the top echelon of high-yield dividend stocks. This impressive yield, however, brings with it the cautionary tale of potential dividend traps, making thorough analysis essential.

Beyond its attractive yield, this entity distinguishes itself with a remarkable history of dividend growth, having increased payouts for more than 25 consecutive years—a record that places it among the top 10% of dividend stocks. Such consistency is not only indicative of stability but also points to potential for future growth.

Year-to-date performance aligns closely with both the broader Energy MLP industry and the S&P 500, with returns around 10%, highlighting its competitive stance in the market. Looking ahead, investors should note the upcoming dividend payout of $0.515 per share, going ex-dividend on April 29. This payout remains consistent with previous distributions, reinforcing the stock’s reliability.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 02 Feb, 2024. The energy infrastructure company demonstrated robust financial and operational performance in 2023, navigating volatile commodity markets to achieve record-breaking results. Generating $7.6 billion in distributable cash flow and retaining $3.2 billion, the company set multiple operational and financial records, underpinned by strong supply and demand fundamentals across key basins.

With $6.8 billion in major organic projects underway, aiming to complete $1.1 billion worth in 2024, the entity is poised for strategic growth. This outlook underscores its resilience and strategic positioning to capitalize on future opportunities, promising for investors seeking stability and growth in the energy sector.

For investors keen on balanced dividend portfolios, an in-depth analysis follows, offering a closer look at the blend of yield, safety, and potential returns that define this standout Energy MLP. Such scrutiny ensures a well-rounded understanding, paving the way for informed investment decisions in a sector that promises both challenges and rewards.