In the landscape of dividend investing, a standout performer has consistently proven its worth through its remarkable track record and strategic positioning. This well-covered mega-cap consumer products stock, a veteran in the market, has maintained a 50+ year streak of dividend increases, placing it in the top 10% of dividend stocks. This achievement not only highlights its historical performance but also sets a promising outlook for future increases.

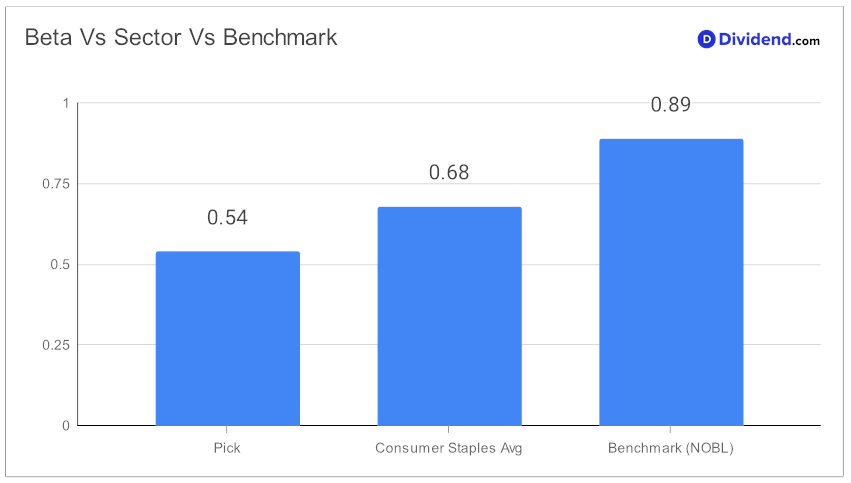

Investors seeking to mitigate market volatility will find reassurance in the stock’s low beta of 0.54, indicating that its monthly returns exhibit minimal correlation with broader equity markets. This characteristic makes it an ideal choice for diversifying an equity portfolio, offering a buffer against market fluctuations.

The company’s upcoming dividend payout is estimated at $1.265 per share, anticipated on or around February 1st. This payout is a testament to the company’s robust financial health and commitment to shareholder returns.

Our in-depth analysis delves deeper into the stock’s performance, evaluating it against a balanced mix of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 10, 2023.

This comprehensive review provides a nuanced understanding, crucial for balanced dividend investors seeking informed decisions in their portfolio construction. Stay tuned for a detailed exploration that will uncover the layers behind this impressive dividend journey.