Investors seeking a balance between reliable dividends and growth potential have a new contender to consider in their portfolios. Recently added to the Best Dividend Stocks model portfolio, this large-cap Chemicals stock stands out for its exceptional dividend track record. It boasts a 48-year history of dividend increases, a feat that places it in the top 10% of dividend-paying stocks. What’s more, this trend is expected to continue, making it a compelling option for balanced dividend investors.

For those eyeing immediate returns, the next payout is particularly attractive. Shareholders can look forward to an unchanged qualified dividend of $1.750 per share, with the ex-dividend date set for December 29. This consistent payout underlines the stock’s commitment to shareholder value.

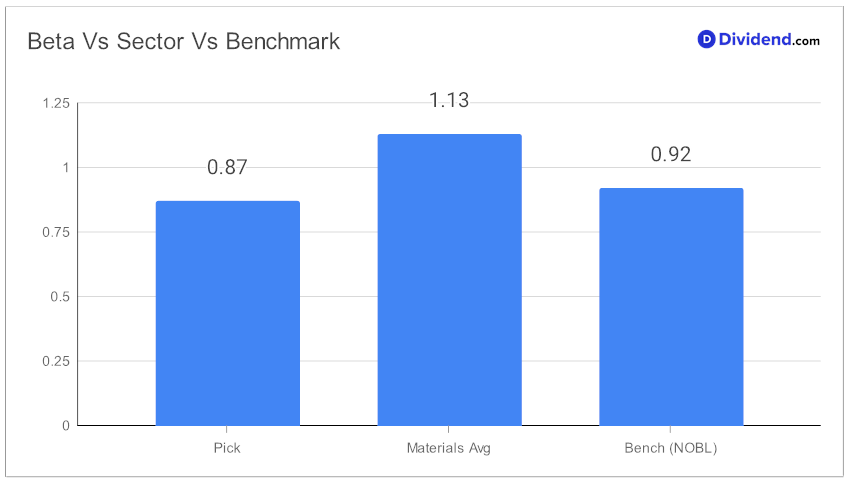

The stability of the business enables our pick to have a beta of 0.87, suggesting a moderate level of volatility compared to the broader market. Additionally, this is comparatively less than the beta of the materials sectors and this portfolio.

But the appeal of this stock goes beyond its dividend history. It has been carefully selected for the Best Dividend Stocks model portfolio through a rigorous process that balances Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. Each of these factors has been meticulously analyzed to ensure that the stock not only provides a steady income stream but also holds potential for capital appreciation.While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on November 8, 2023.

This detailed examination provides insights into why this stock is a worthy addition to any balanced dividend investment strategy, solidifying its position as a prudent choice in a well-rounded investment portfolio.