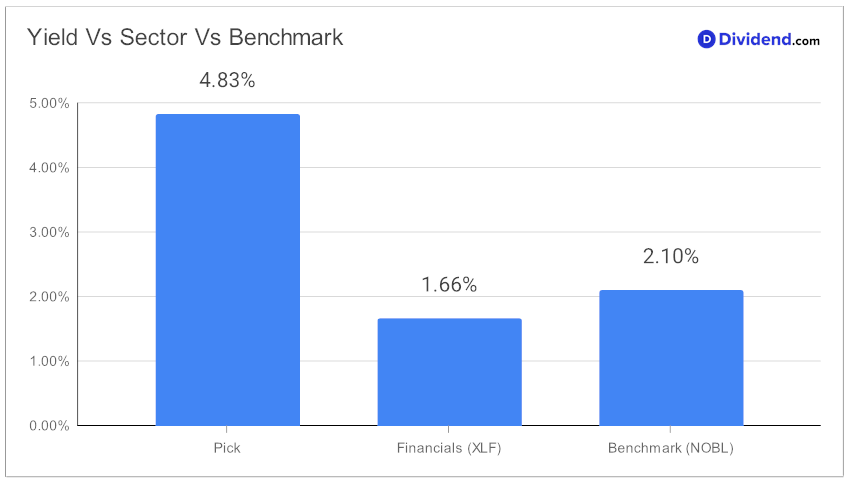

In the dynamic landscape of dividend investing, a large-cap insurance stock has recently emerged as a noteworthy addition to a prestigious model portfolio. This inclusion is driven by its compelling forward dividend yield of 4.83%, a figure that not only surpasses the insurance industry’s average of 2.7% but also positions it in the top 40% of dividend-yielding stocks. The stock’s payout ratio stands at a prudent 36%, aligning closely with industry norms and underscoring its financial health.

Investors are drawn to its impressive 16-year history of dividend increases, a trend that is anticipated to continue, marking it as a beacon of reliability in a volatile market. With a year-to-date return of 5%, mirroring the S&P 500 and outperforming the industry average, its financial performance speaks volumes. The upcoming payout, a 4.0% increase to $1.300 per share, which went ex-dividend on February 16 with a March 14 pay date, further highlights its attractiveness.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 7, 2024. The firm reported strong financial performance for 2023, underpinned by robust sales momentum in its insurance and retirement sectors, and strategic advancements aimed at enhancing capital efficiency and market expansion. Despite macroeconomic challenges, the firm’s strategic initiatives, strong capital position, and a solid dividend profile demonstrate its potential for sustained growth and resilience in the current economic landscape.

This stock’s strategic selection for the model portfolio, grounded in a balanced evaluation of yield attractiveness, dividend safety, returns potential, and risk, sets a promising stage. The forthcoming in-depth analysis will delve deeper into its merits, offering investors a comprehensive understanding of its standing in the dividend investment domain.