In the realm of dividend investing, a new star has emerged, joining the ranks of the most sought-after holdings in a renowned Dividend Stocks model portfolio. This addition stands out not only for its robust presence in the Oil/Gas/Coal industry but also for its impressive financial metrics that make it a prime candidate for balanced dividend investors.

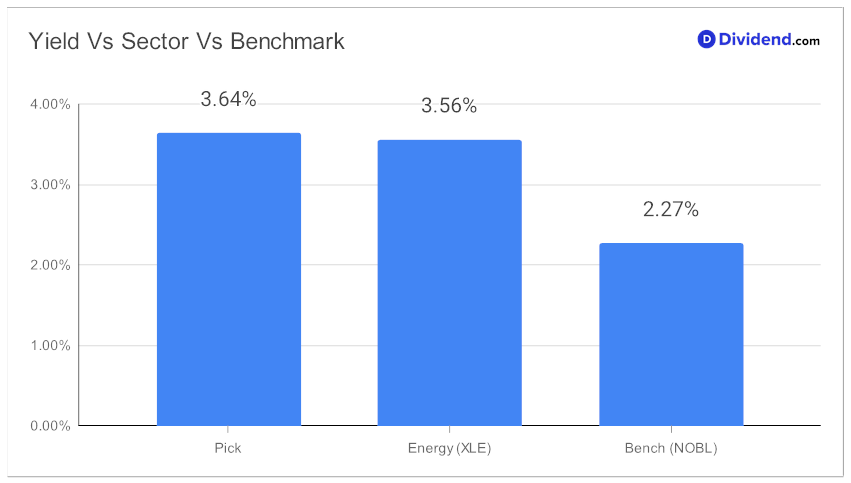

A key highlight of this stock is its remarkably low forward payout ratio of 39%, aligning closely with the industry average. This indicates a sustainable dividend policy, ensuring that payouts to shareholders are well-covered by earnings. But what truly sets this stock apart is its extraordinary track record of dividend increases. For 41 years, it has consistently raised dividends, positioning it in the top 10% of dividend stocks, with expectations for future growth. The stock also yields 3.64%, slightly better than than the portfolio benchmark.

For those eyeing the next payout, there’s good news. Shareholders can anticipate a 4.4% increased qualified dividend of $0.950 per share. The ex-dividend date recently passed on November 14, paving the way for a December 11 payout. This upcoming dividend reflects the company’s commitment to rewarding its investors and underscores its reliability in the dividend space.

Like some other players in the energy sector, the company is looking to diversify so that it can shield itself from the oil and gas price volatility. Within that context, it plans to enter the lithium production race in a big way with an eye to becoming a leading player in the battery metal space. Given its vast expertise in drilling, pumping, and processing oil and gas, there are high chances that this will provide the company a much-needed shift in strategic focus investors were hoping for.

The selection of this stock for the portfolio wasn’t random. It underwent a rigorous recommendation process, balancing factors like Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. The result? A stock that not only promises steady income through dividends but also offers a balanced risk-reward profile. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 28, 2023.

For a deeper dive into why this stock is a compelling choice for dividend investors, the following in-depth analysis sheds light on its financial health, market position, and future prospects.