Looking for a sturdy addition to your dividend portfolio? Consider this well-positioned large-cap stock in the Home/Office Products industry. With a forward payout ratio of just 34%, this company not only maintains a low distribution but also falls in line with the industry average of 32%. Such a healthy payout ratio points to sustainability, giving dividend investors an extra layer of comfort.

While dividend sustainability is key, what about growth? This stock has a 13-year record of increasing its dividend, ranking it in the top 10% of all dividend stocks. Future dividend hikes are also expected, fortifying its position as a growth and income vehicle. Its 3-year dividend per share compound annual growth rate (CAGR) of 13% places it in the top 40% of all dividend stocks, making it a compelling pick for those interested in both capital appreciation and income.

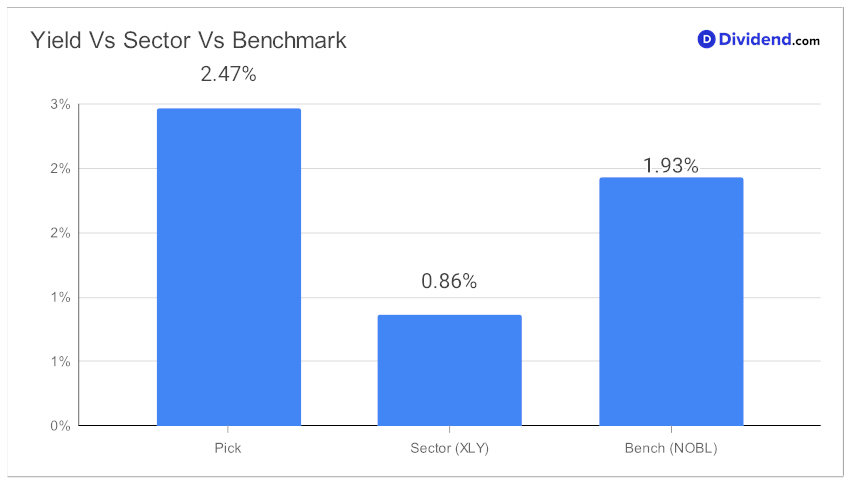

Despite yielding a modest 2.47%, the stock’s yield is higher than that of the sector average and the portfolio benchmark.

Performance-wise, the stock has returned 15% year-to-date. Although trailing the S&P 500’s 17% and the industry average of 21%, it still shows promise in a diversified portfolio optimized for a balanced mix of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk.

Let’s not forget the near term: an estimated next payout of $1.620 per share is expected around November 3rd.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 21, 2023.

Make sure to delve into the in-depth stock analysis that follows to understand all the nuances that make this stock a worthy consideration.