Discover the resilience of one standout company in the Consumer Discretionary Retail sector, confidently holding its position in our Best Dividend Stocks model portfolio. With a forward payout ratio of just 39%, this stock not only demonstrates a prudent return of capital but also aligns closely with the industry’s average, striking the right balance in a field known for its competitive dynamics.

Diving deeper reveals an impressive legacy of shareholder commitment. For 60+ consecutive years, this company has not just maintained but increased its dividends, a feat placing it in the upper echelon of dividend stocks. This consistency signals a strong strategic focus and financial health, crucial for balanced dividend investors prioritizing stability and reliability in their portfolios.

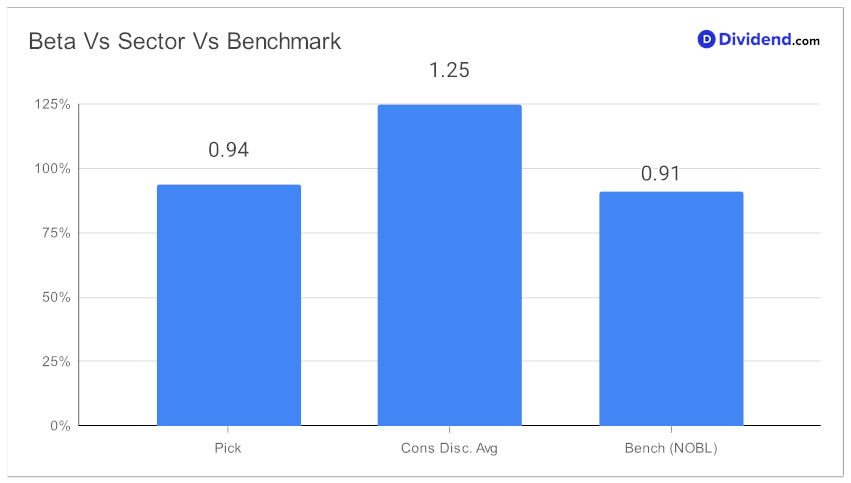

The stock currently has a beta of 0.94, indicating volatility in line with the broader market. However, it is less volatile compared to the overall Consumer Discretionary sector.

Investors, mark your calendars! The next rewarding payout is just around the corner, with an anticipated $0.950 per share distribution expected approximately on November 14.

Stay with us for an in-depth analysis, where we unravel how this entity stands up to our rigorous vetting process, optimizing for an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 20, 2023.

Beyond the numbers, we delve into the strategic nuances of making this stock a portfolio mainstay for discerning investors.