Discover a New Addition to Our Model Portfolio: A Top-Performing Dividend Stock.

In the world of dividend investing, finding the right balance between yield attractiveness and safety is crucial. Our latest addition to the Best Dividend Stocks model portfolio exemplifies this balance, standing out as a well-covered large-cap eREIT. This stock has a remarkable history of dividend increases, with a 10-year track record that places it in the top 30% of dividend stocks. This consistency is not just a testament to its past performance but also a promising indicator for future increases.

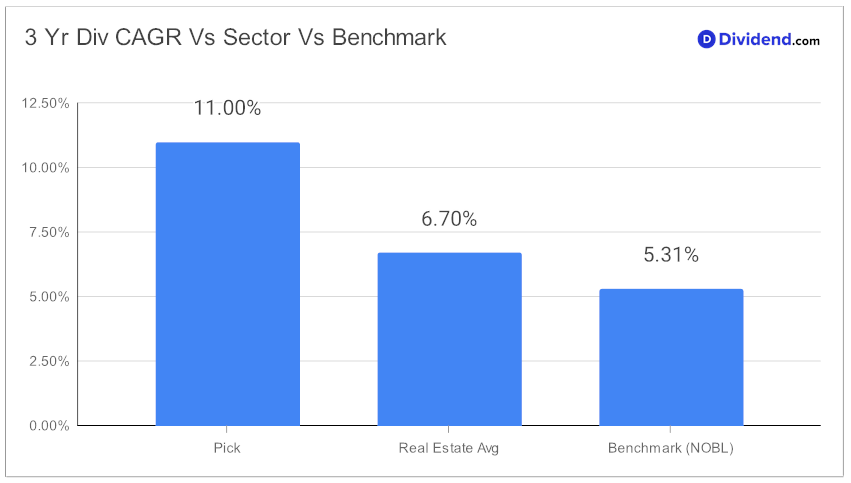

Diving deeper, its 3-year dividend per share compound annual growth rate (CAGR) of 11% ranks it in the top 40% of all dividend stocks, showcasing its robust growth trajectory. What makes this addition even more enticing is the upcoming payout – investors can expect an estimated $0.870 per share on or around February 23. This upcoming payout is not just a reward for current investors but also an opportunity for new investors to partake in the stock’s dividend benefits.

Our recommendation process for this stock has been thorough, focusing on an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 17, 2023.

The in-depth analysis that follows delves into these aspects, providing a comprehensive understanding of why this stock is a must-consider for balanced dividend investors.