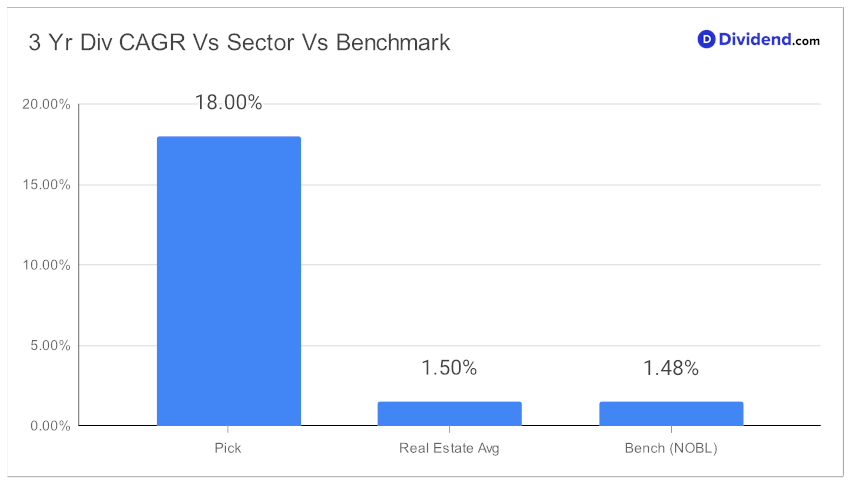

In the realm of dividend investing, where stability meets growth, a certain mid-cap eREIT stands out, marking its territory as a formidable contender in the Best Dividend Stocks model portfolio. This company, with its impressive 12-year streak of dividend increases, not only ranks in the top 10% of dividend stocks but also signals a future bright with potential hikes. Its 3-year dividend/share compound annual growth rate (CAGR) of 18% places it in the elite top 40% bracket, showcasing a blend of reliability and growth that balanced dividend investors seek.

As we edge closer to December, eyes are set on the next expected payout, estimated at a generous $1.270 per share. This anticipation aligns with the company’s recent performance, which has seen a 16% return year-to-date, surpassing the eREIT industry average and closely tailing the S&P 500’s 19%.

Despite market uncertainty in the industrial real estate space, especially in terms of new construction starts and lease term negotiations, the company remains cautious in allocating capital and strengthening its balance sheet. This has helped the company report a 13% rise in fund flow from operations (FFO) in the latest reported quarter, which was also marked by strong metrics, including percent leased and same-store net operating income growth. Additionally, low industrial vacancy rates coupled with moderating supply in 2024 are expected to further boost the company’s prospects.

Our in-depth analysis peels back the layers of this dividend powerhouse, exploring its journey through the lenses of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

This balanced approach in our recommendation process not only highlights the eREIT’s strong points but also offers a comprehensive view, allowing investors to make informed decisions in their pursuit of stable and growing dividends.