Take a glimpse into the hall of fame of dividend stocks, where a superstar with a sterling 52-year track record of dividend increases resides, placing it within the top 10% of dividend stocks. The allure is not solely in its rich history, but in the expected future increases as well. With a low 0.55 beta, this uncorrelated investment serves as an excellent diversifier for an equity portfolio, reducing market-induced turbulence.

In a roller-coaster year where the S&P 500 soared by 14%, and the Consumer Products industry dipped by 2%, our focus stock maintained a steady 3% return.

The icing on the cake?

The upcoming 10% increase on a qualified dividend payout of $1.265 per share, which went ex-div on June 1 and is payable on June 30.

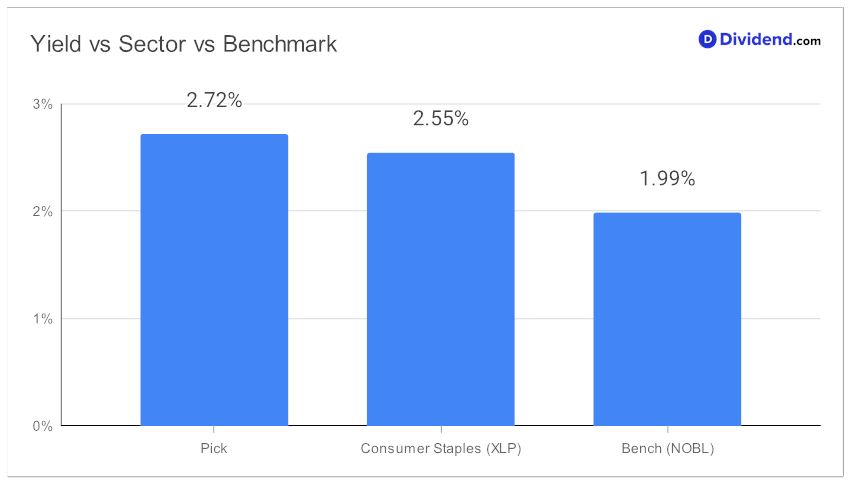

Dive into our in-depth analysis to uncover the name of this well-covered mega-cap Consumer Products stock, as we balance Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk to optimize your investment portfolio.