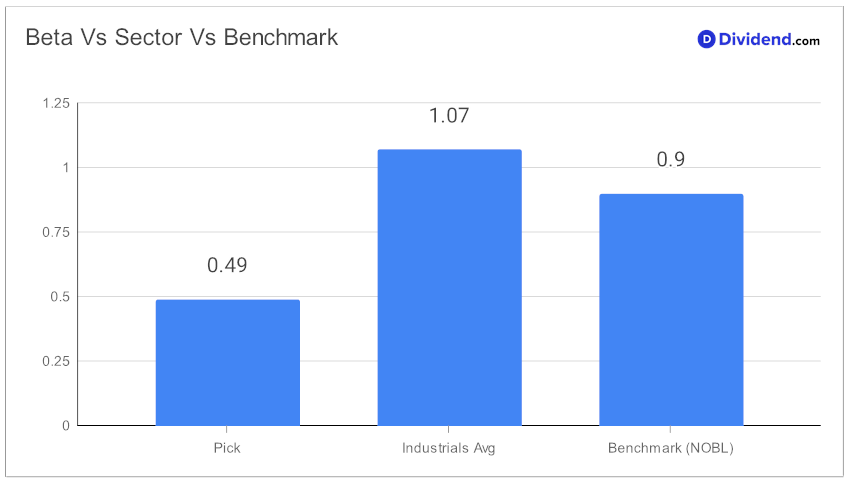

In the ever-evolving landscape of dividend investing, a standout large-cap Aerospace & Defense stock has made a compelling case for its place in a well-curated portfolio, especially for those with an eye on balanced dividend returns. With an impressive 20+ year history of dividend increases, this entity not only ranks in the top 10% of dividend-yielding stocks but also signals a promising outlook for future growth. Investors will find its 0.49 beta particularly attractive, indicating a low correlation with equity market fluctuations and offering a diversifying buffer to their equity portfolios.

The upcoming payout, holding steady at an unchanged qualified $3.15 per share and going ex-dividend on February 29, underscores the stock’s commitment to rewarding its shareholders consistently. This payment is part of a broader investment narrative that balances yield attractiveness, dividend safety, returns potential, and risk, optimized through a meticulous selection process.

Our in-depth analysis delves into the nuances of this stock’s performance, shedding light on its strategic position within the aerospace and defense sector and offering insights into how it complements a balanced approach to dividend investing. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 23, 2024.

This exploration not only reaffirms its value but also provides a comprehensive look at the factors contributing to its esteemed status among dividend stocks.