Experience the blend of high returns and reliability in your investment portfolio. Our Best Dividend Stocks model portfolio reinstates a mega-cap Cons. Discr. Retail stock that has a remarkable 14-year track record of increasing dividends.

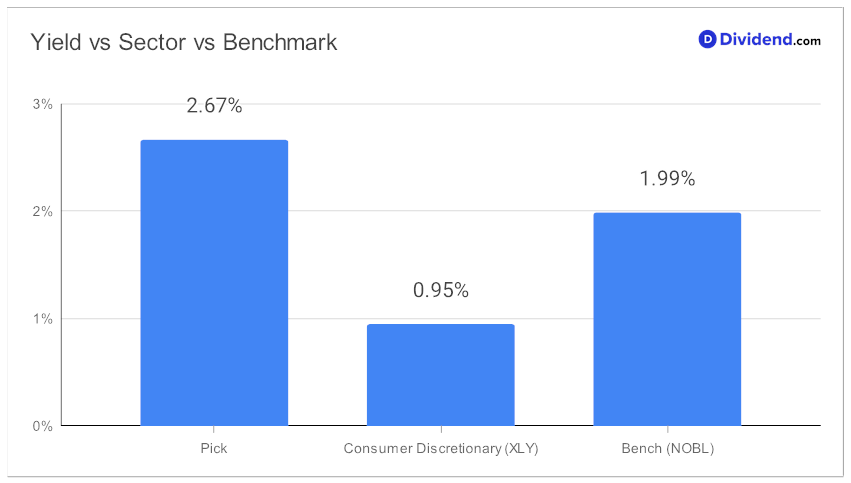

Ranked within the top 10% of all dividend stocks, this stalwart presents a future ripe with anticipated dividend increments. The stock also boasts an impressive 12% 3y dividend/shr CAGR, placing it comfortably in the top 40% of dividend stocks. At the same time, it boasts a forward dividend yield of 2.67%, comfortably beating its sector average and benchmark for this portfolio.

Looking for diversification?

Its 0.95 beta demonstrates minimal correlation with the equity market, a perfect addition to balance your equity portfolio. Moreover, investors can eagerly anticipate the next payout of an estimated $2.090/shr around August 18.

Our recommendations optimize for a harmonious mix of Yield Attractiveness, Dividend Safety, Returns Potential and Returns Risk. Dive in for an in-depth analysis to fully explore the abundant prospects this stock holds for balanced dividend investors.