In the world of dividend investing, consistency and reliability often take center stage. This is especially true for a large-cap Aerospace & Defense stock that has recently made headlines in the Best Dividend Stocks model portfolio. Renowned for its robust track record in dividend increases – spanning over three decades – this stock stands as a testament to steadfast financial resilience and growth. Its 30+ year history of dividend growth not only places it in the elite top 10% of dividend stocks but also signals strong future prospects for dividend investors.

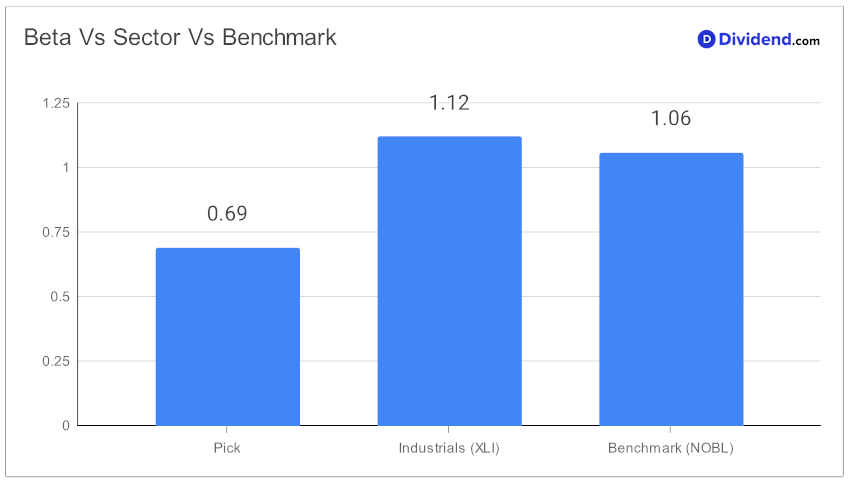

What’s particularly compelling about this stock is its balance of yield and risk. With a payout ratio of 32%, it mirrors the industry average, ensuring that dividend payments are well-covered without overextending the company’s financial resources. This prudent financial management is further highlighted by its low beta of 0.69, suggesting that its monthly returns exhibit lower volatility compared to the broader equity market. This trait is invaluable for investors seeking to diversify their equity portfolios with less market-correlated assets.

The performance of this stock also stands out in comparison to its peers and broader market indices. Year-to-date, it has outperformed with a 4% return, surpassing both the S&P 500 and its industry average. This trend of outperformance is not just a flash in the pan but a characteristic feature of this stalwart stock. Additionally, since making it to this portfolio back in August 2022, the stock has managed to comfortably beat the benchmark.

Investors should note the upcoming dividend payout, remaining unchanged at $1.320 per share. This next payout, with an ex-dividend date of January 18 and a pay date of February 9, continues the company’s tradition of rewarding shareholders consistently.

For balanced dividend investors, this in-depth stock analysis serves as a gateway to understanding not just the stock’s past performance but also its future potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 24, 2024.

This blend of historical consistency, financial prudence, and ongoing performance makes it a noteworthy consideration for those optimizing for a mix of yield attractiveness, dividend safety, returns potential, and returns risk.