In the realm of dividend investing, the allure of stability and consistent returns is paramount. Today, we spotlight a prominent player in the Integrated Utilities sector, renowned for its well-covered large-cap stature.

With a forward dividend yield of 3.73%, this stock not only offers an attractive yield that stands above the industry average but also promises a substantial payout, estimated at $0.780 per share, coming up on or around December 13th.

What sets this stock apart is its remarkable 20-year track record of dividend increases, placing it in the elite top 10% of dividend stocks. This history not only underscores its financial robustness but also hints at promising future increments.

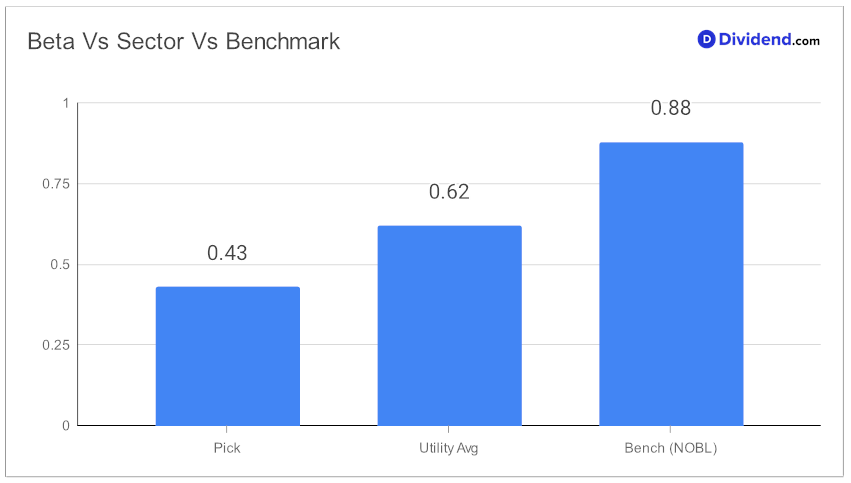

Moreover, its low beta of 0.43 is a testament to its resilience, suggesting a low correlation with broader equity market fluctuations. This characteristic makes it an ideal candidate for diversifying an equity portfolio, offering a shield against market volatility.

Our comprehensive recommendation process, prioritizing an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk, underscores our commitment to balanced dividend investing. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 1, 2023.

The detailed stock analysis that follows will delve deeper into this stock’s potential, providing insights essential for every balanced dividend investor seeking to fortify their portfolio. Stay tuned for an in-depth exploration of this dividend champion, where stability meets growth.