In the realm of balanced dividend investing, a well-covered large-cap Integrated Utilities stock has recently been added to the coveted Best Dividend Stocks model portfolio. With a commendable 4.31% forward dividend yield, this stock not only outpaces the industry average of 4.1% but also positions itself in the top 40% of dividend-yielding stocks.

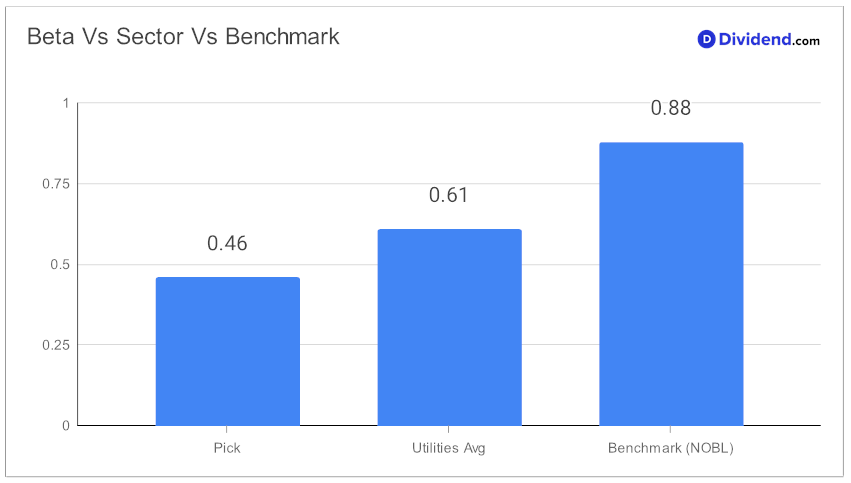

Its 19-year streak of dividend increases propels it further into the elite top 10%, signaling a robust and growing payout to its investors. The low correlation of its monthly returns to broader equity markets, as indicated by a 0.46 beta, further underscores its potential to diversify an equity portfolio effectively.

As investors gear up for the next payout, estimated at $1.025 per share on or around May 3, the stock’s addition to the model portfolio is a testament to its balanced blend of yield attractiveness, dividend safety, returns potential, and risk.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 09 Feb, 2024. The utility company reported a successful fiscal year, aligning with projected financial guidance and showcasing operational excellence. The company, amidst a strategic pivot towards regulated utility operations, demonstrated adaptability by divesting its commercial renewable assets. Management highlighted a significant increase in capital expenditures aimed at supporting energy transition, grid reliability, and customer service improvements. Despite facing challenges such as mild weather and higher interest expenses, the utility’s focus on cost management and operational efficiency was emphasized as central to meeting financial commitments and supporting sustained growth.

The company projected a 6% growth in earnings per share (EPS) for the upcoming year, with an ambition to sustain a 5% to 7% growth rate through 2028.

This selection process ensures that investors are guided towards not just immediate gains but sustained growth and stability. Dive deeper into our comprehensive analysis to understand why this Integrated Utilities stock stands out in a crowded market, offering a promising avenue for those aiming to balance yield with prudent investment strategies.