In the ever-evolving world of investments, a stalwart performer in the Aerospace & Defense sector continues to fortify its standing in the Best Dividend Stocks model portfolio.

With a two-decade-long track record of dividend increases, it proudly situates within the top 10% of all dividend stocks, offering promising expectations for future growth. It also presents an enticing beta of 0.65, indicating minimal correlation to equity markets, and therefore, serves as an effective diversifier for your portfolio.

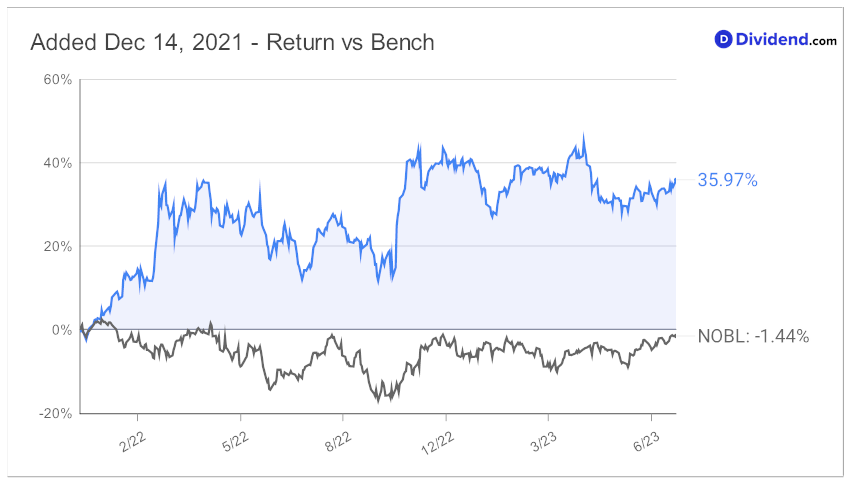

Additionally, since making it to this portfolio back in December 2021, our defense pick has managed to beat the portfolio benchmark by a significant margin.

The next payout is an unaltered, qualified $3.00 per share, expected to go ex-dividend on August 31.

By focusing on an optimal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk, we aim to guide balanced dividend investors towards their financial goals. Unearth the details in our comprehensive stock analysis that delves deeper into the unique strengths and returns potential of this prominent large-cap stock.