Discover how a seasoned giant in the Gaming, Lodging, and Restaurant industry secures a steadfast position in the Best Dividend Protection Stocks model portfolio, catering to retirement dividend investors.

This mega-cap stock brandishes a compelling 46-year record of dividend increases, ranking in the top 10% of dividend stocks, promising future hikes.

Boasting a low 0.64 beta, it showcases low correlation with equity markets, providing a diversified addition to your portfolio. Even with an 11% return YTD, trailing behind the S&P 500 and industry average, its steady and reliable performance cements its status.

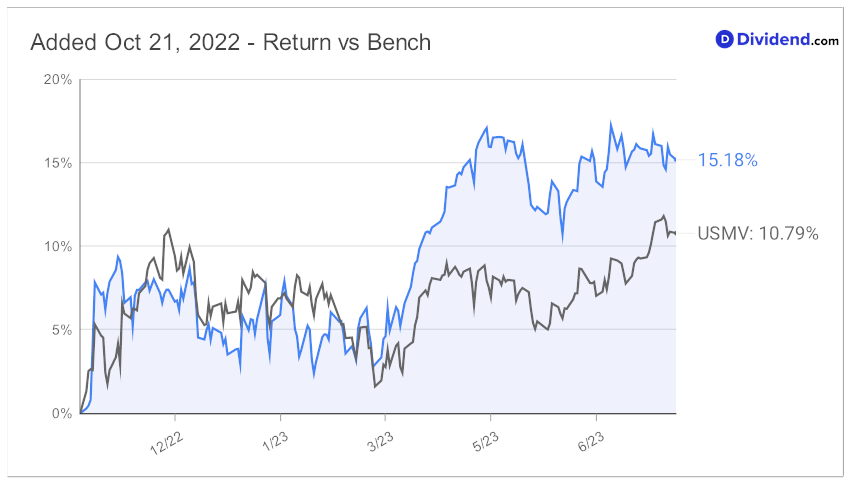

This is further evident from the stock beating its benchmark by a significant margin since making it to this portfolio back in October 2022.

Furthermore, anticipate an unchanged next payout of a qualified $1.520/share going ex-dividend on August 31st.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on July 27, 2023.

Optimized for Dividend Safety and Returns Risk, this stalwart also shows promise in Yield Attractiveness and Returns Potential.

Delve into our comprehensive stock analysis following this teaser for a deeper understanding of how it safeguards your dividends.