For retirement dividend investors seeking stability and growth, the latest analysis in our Best Dividend Protection Stocks model portfolio offers a compelling look at a top-performing mega-cap stock in the Gaming/Lodging/Resto industry.

This company stands out with its remarkable 40+ year history of dividend increases, placing it in the elite top 10% of dividend stocks. What’s more, it shows promising signs of future increases.

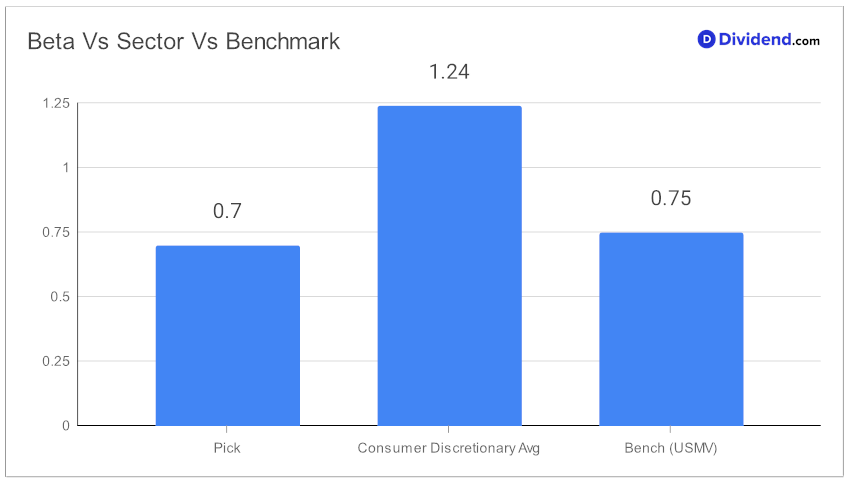

The stock’s low correlation to equity markets, indicated by a beta of 0.70, makes it an excellent choice for diversifying your portfolio. In terms of performance, it has already delivered an 11% return this year, outpacing its industry but trailing the S&P 500. The next payout is particularly noteworthy: a substantial 9.9% increase to a qualified $1.670 per share, going ex-dividend on November 30th with a December 15th payment date.

Our recommendation process prioritizes Dividend Safety and Returns Risk, with secondary consideration to Yield Attractiveness and Returns Potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 30, 2023.

This stock not only meets these criteria but also offers a rare blend of reliability and growth potential. The upcoming detailed stock analysis will dive deeper into these aspects, providing a clearer understanding of why this stock is a must-have in your retirement portfolio.