When considering dividend stocks for retirement, it’s essential to focus on companies that provide a combination of dividend safety, attractive yields, and returns potential. One particular stock in the Gaming/Lodging/Resto industry has stood out as a top choice for the discerning investor. This large-cap stock has a remarkable track record of dividend increases of over 40 years, placing it in the top 10% of all dividend-paying stocks. Future dividend hikes are anticipated, making it a robust candidate for consistent income.

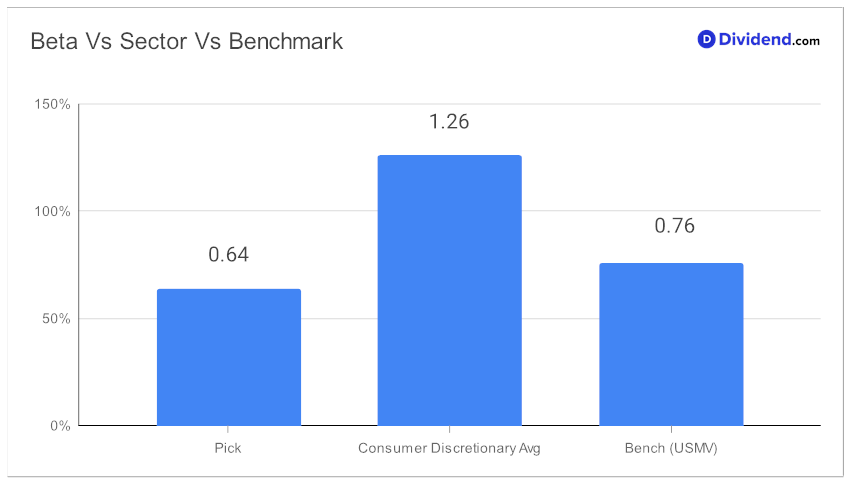

If you’re concerned about market volatility, this stock has a low beta of 0.64, suggesting it doesn’t closely follow the broader equity markets. This feature makes it an excellent choice for diversifying an equity portfolio, shielding it from extreme market fluctuations.

However, it’s worth noting that the stock has returned 1.7% year-to-date, trailing both the S&P 500’s 14% and its industry’s 3%.

Lastly, if you’re eyeing the next payout, it’s expected to distribute an estimated $1.520 per share on or around October 13. This reaffirms the company’s commitment to rewarding shareholders.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 27, 2023.

For an in-depth analysis of this compelling investment, keep reading to better understand how this stock is optimized for both dividend safety and returns risk, and to a lesser extent, yield attractiveness and returns potential.