In the realm of investment, particularly for those eyeing a stable retirement phase, certain stocks indeed act as pillars of strength, promising consistent dividends coupled with a security blanket against market volatility. One such champion in our Best Dividend Protection Stocks model portfolio hails from the Waste & Environment industry, a stalwart that has not only stood the test of time but also promises a future of resilience and reward.

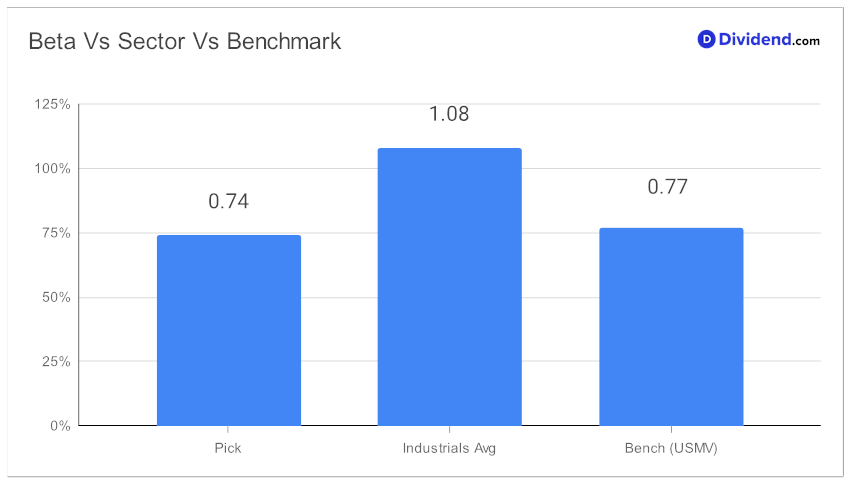

Reflecting on its laudable track record, the stock prides itself on a 20-year history of dividend increases, a consistency that places it in the elite top 10% of dividend stocks. This reliability, fused with expectations of continued growth, earmarks it as a treasure for retirement planners. Adding to its charm is a 0.74 beta, indicating a low correlation with equity markets—a strategic diversifier for your portfolio.

Despite a modest Year-To-Date (YTD) return of 2%, lagging behind the S&P 500 and its industry peers, the company’s stability is its standout feature, offering a buffer during market downturns. It’s not all about rapid growth; it’s the promise of steady, unwavering returns, essential for post-retirement peace of mind.

What’s immediately arresting for investors is the forthcoming dividend payout, estimated at $0.700 per share, projected for disbursement around November 8. This tangible near-term return stands as a testament to the stock’s enduring value proposition.

However, the real magic lies beneath these highlights. An in-depth stock analysis that follows peels back the layers, providing investors with a comprehensive understanding, aligning with our rigorous recommendation process optimized for Dividend Safety and Returns Risk. While Yield Attractiveness and Returns Potential are also considered, the primary lure remains its steadfast nature—a guardian against the ebb and flow of market tides. Additionally, we’ve factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 26, 2023.

Dive deeper into the subsequent analysis to unravel how this waste management titan could be the bedrock for your dividend-earning retirement portfolio.