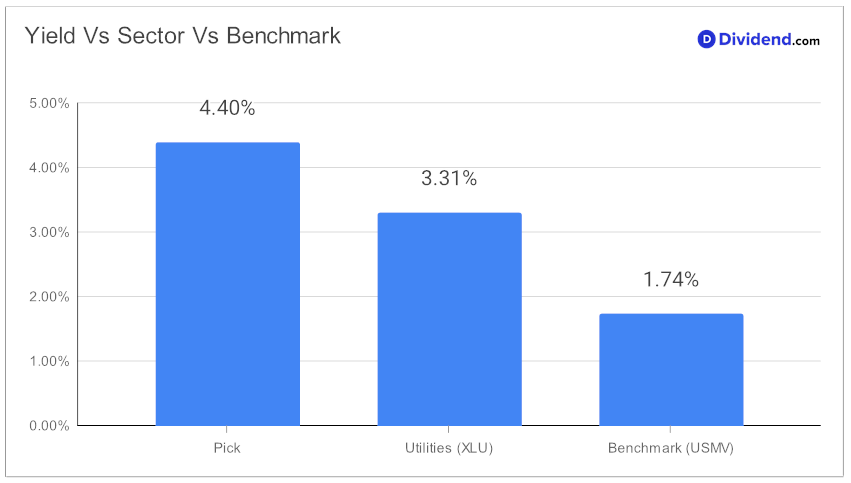

In the realm of retirement investment, the allure of a consistent and safe dividend is unparalleled. Among the most commendable options, a notable large-cap stock within the Integrated Utilities sector stands out, showcasing a robust forward dividend yield of 4.40%. This yield not only surpasses the industry average of 3.9% but also positions it in the top 40% of dividend-yielding stocks. Its commendable 20-year track record of dividend increases further cements its status, placing it in the elite top 10% of dividend stocks, with expectations of continued growth.

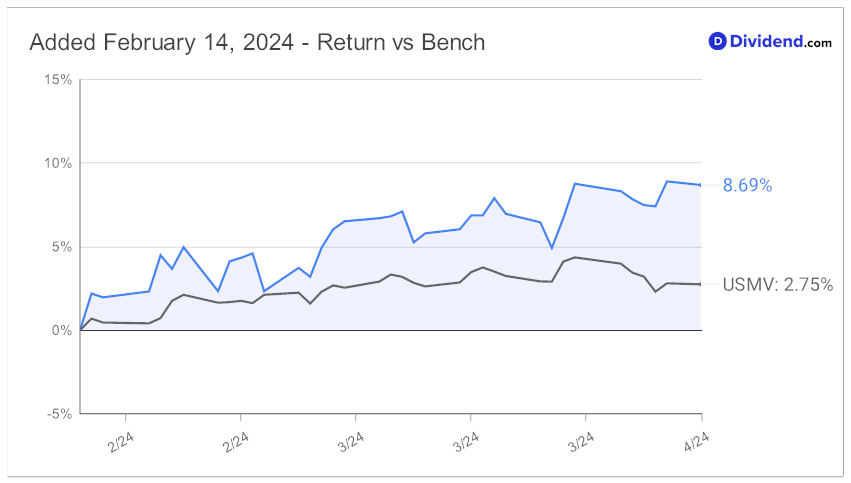

Since making it to this portfolio back in February 2024, the stock has managed to stay ahead of this portfolio’s benchmark.

For those eyeing their next income opportunity, the anticipation hovers around an estimated dividend payout of $0.780 per share, projected to delight shareholders on or around June 21st. This selection, meticulously optimized for Dividend Safety and Returns Risk, also considers Yield Attractiveness and Returns Potential, albeit to a lesser extent.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 23 Feb, 2024. The utility company reported a successful fiscal year with a core Earnings Per Share (EPS) exceeding forecasted ranges, demonstrating resilience and strategic foresight amidst industry challenges such as regulatory delays. The company notably surpassed its wildfire mitigation targets, significantly enhancing system reliability and reducing wildfire risks. This achievement underscores its commitment to safety and operational excellence.

Looking ahead, it plans continued investments in operations and maintenance (O&M) to support a transition to green energy, expecting to benefit both customers and shareholders. The firm announced a nearly 6% increase in its annual dividend, marking continuous growth and reflecting confidence in long-term EPS growth targets. This outlook presents a blend of operational success and strategic financial planning aimed at sustained growth and shareholder value.

Diving deeper, an upcoming in-depth analysis will unravel how this stock stands as a beacon for retirement dividend investors, offering a compelling blend of stability and growth potential.